- The Moneycessity Newsletter

- Posts

- BEST Credit Card In 2024 | Ranking Top 40 Credit Cards

BEST Credit Card In 2024 | Ranking Top 40 Credit Cards

I spent over 325+ hours analyzing 40 top credit cards from Capital One, Chase, American Express, Discover, Citi, and many more. You can now find the perfect card based on actual budgets and spending preferences to maximize your rewards and make informed financial decisions. Check out my FREE spreadsheet including formulas to help you compare points, bonuses, spending categories, annual perks, and sign-up bonuses!

Many credit cards have been forged for the realms of man: 6 from Chase, 7 from Capital One, 7 from American Express, and many, many more.

But there can only be one credit card to rule them all.

I have compiled the points and the bonuses from 40 of the most popular credit cards and spent more time than Frodo Baggins taking the ring to Mount Doom to compile them all into one master spreadsheet.

Finally, we can determine the one true ultimate credit card.

On the go? Watch my video HERE.

At the end of the day, calculating the best credit card for you is just simple math. If you know your budget and you know exactly how much you’re going to spend in the relevant categories, then you can determine exactly the best credit card for you.

Nerd Wallet credit card ranking

If you look to websites like Nerd Wallet or the Points Guy, all you’re going to get is a rating out of 5 stars, and that’s only going to get you so far.

We’re going to look at the actual amount of points you get from different spending levels and different spending types. As I’ve said, I’ve created the ultimate spreadsheet with 40 of the top credit cards. Let’s quickly go over my methods and then we’ll get into the results.

3 Things to Consider Before You Pick a Card

1. Spending

The first thing you have to look at is your spending. It’s pretty intuitive.

Are you getting points or are you getting miles?

Do you have to spend money at specific stores?

Is it rotating categories?

Do you spend money on gas or restaurants?

2. Annual Perks

The second source of points I want to look at is the annual perks.

Are you getting Global Entry Pre-check for free?

Are you getting lounge access?

Are you getting certain memberships for free?

All of these things are going to add value and they have to be taken into account.

An important feature of this spreadsheet is the user profile section that takes into account different spending habits that you might have and different memberships that you might utilize.

That way, credit cards that you’re not going to get advantages from do not factor into the point total.

User profile section from the Ultimate Spreadsheet

For instance, I’ve got a zero in the Clear Plus section of the user profile for the American Express credit cards. My wife and I use Global Entry, so we can put a zero there. The same goes for Equinox, Home Chef, Walmart, and Disney. We don’t use any of these memberships.

3. Sign-up Bonuses

The third source of points I want to look at is sign-up bonuses.

Are you getting a big chunk of points up front?

Are you getting all your points matched in that first year? This is another source of value. It’s mainly going to come into play if you’re looking at churning your credit card, but it’s something we’re going to look at nonetheless.

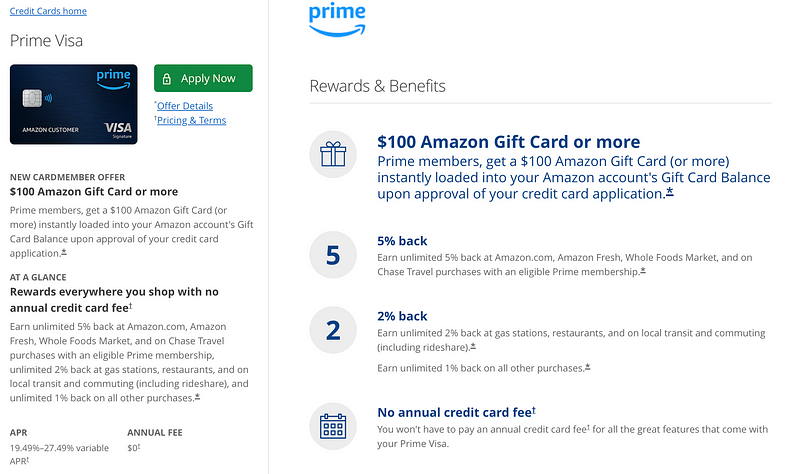

Chase Prime Visa rewards and benefits

As an example to illustrate the different kinds of points per dollar spent categories you might see is the Prime Visa.

With the Prime Visa, you get a minimum of 1 point per dollar spent. Additionally, you also get 2 points for gas stations and dining, and 5 points for Chase Travel, Whole Foods, Amazon Fresh and all Amazon purchases.

2 Sections of the Ultimate Spreadsheet

For this article, I’m going to look at these different credit cards using my actual budget so we can see beyond a doubt which card is going to be best for us. We’ll also show you some of the top credit cards at different spending levels so you can see for yourself where you might fall into place.

My Ultimate Credit Card Spreadsheet

The credit card providers in this comparison include:

From Capital One, we’ve got the Venture X, Venture, Venture One, Saver, Saver One, Quicksilver, and Quicksilver One.

From Chase, we have the Sapphire Reserve, Sapphire Preferred, Prime Visa, Freedom Unlimited, Freedom Flex, Freedom Rise.

From American Express, we have the American Express Platinum, Express Gold, Express Green, Blue Cash Preferred, the Blue Cash Every Day, the Amex Every Day Preferred, and the Amex Everyday.

From Discover, we’re looking at the Discover Cash Back, Discover Travel, and Discover Gas and Restaurant.

From Wells Fargo, we’ve got the Active Cash, the Autograph, the BILT Credit Card, the Choice Privileges Select, and the Choice Privileges.

From Citi, there’s the Citi Custom Cash, Citi Premier, and Citi Double Cash.

From Bank of America, we have the Customized Cash, the Unlimited Cash Rewards, the Travel Rewards, and the Premium Rewards.

And finally, a couple of bonus credit cards. We’ve got the X1 from Robinhood, which is really cool, and the Southwest Priority Credit Card from Southwest.

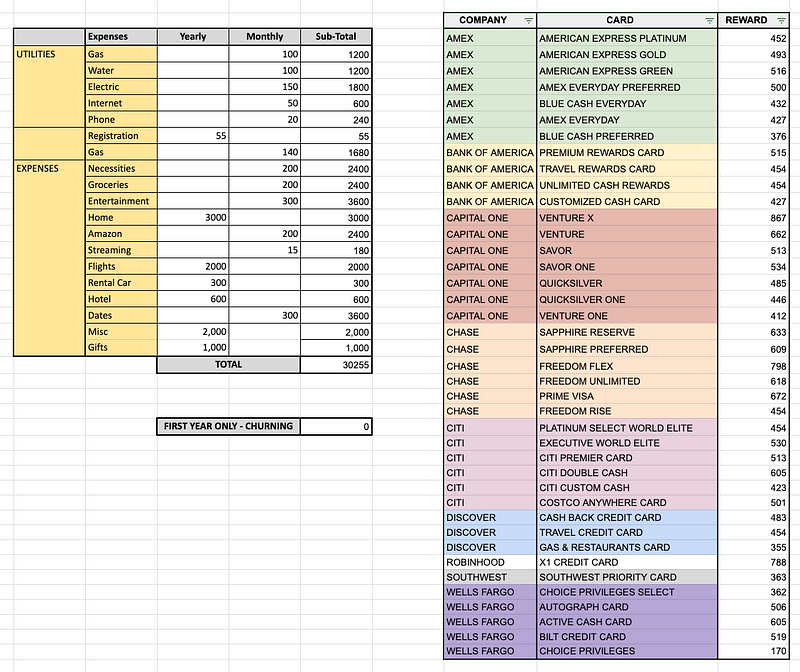

1. My Budget

Now that you’ve seen all 40 of their credit cards that are going into this comparison, let’s take a look at the budget that my wife and I have.

This is our actual spending in all of the relevant categories for the credit cards that I just mentioned. You can look at this budget and see how it compares to yours. If you’d like to do this comparison with your own exact budget, you can find this spreadsheet HERE for free.

My budget from my Ultimate Credit Card Spreadsheet

In the table above, I’ve got our expenses divided into 2 different columns, monthly and yearly.

In the monthly column, we’ve got all of our utilities, gas, water, electricity, internet, and phone. We’ve got a lot of our kind of more variable expenses like groceries, entertainment, and subscriptions.

We have some yearly expenses like gifts, hotel, flights, rental car, and home improvement.

All in all, our yearly spending that we put on our credit card specifically is $30,255.

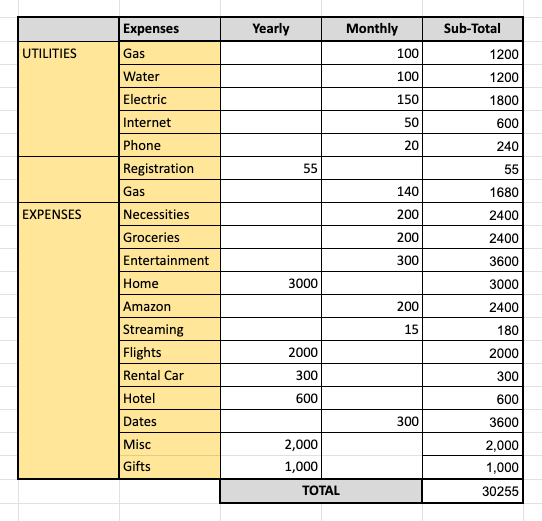

2. My Credit Card Ranking

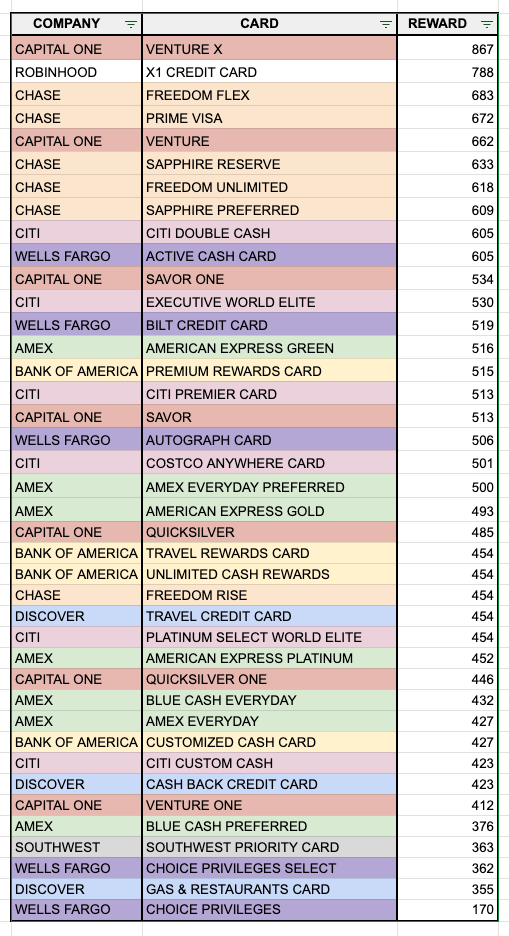

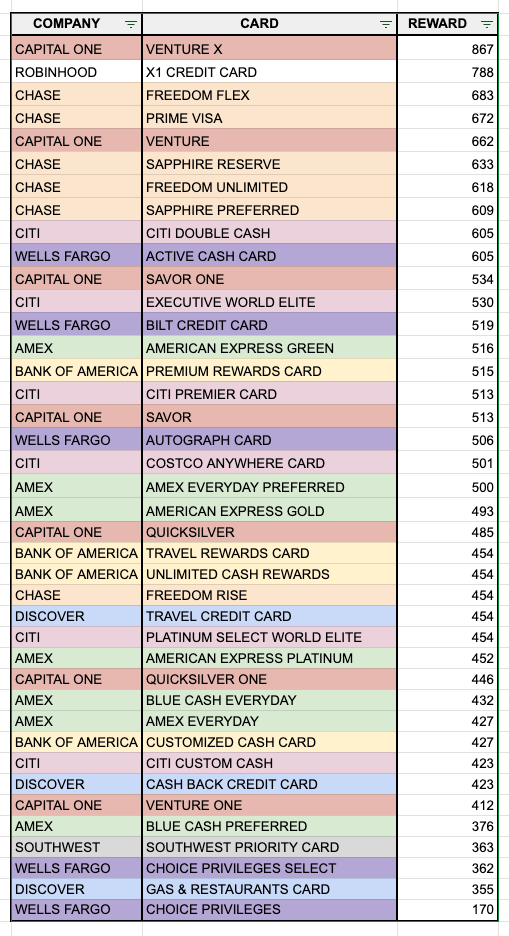

All right, now when we look over here at the results, you can see that at first, we’ve got everything color-coded and divided by credit card provider: Amex, Bank of America, Capital One, Chase, et cetera.

Credit card ranking from my Ultimate Credit Card Spreadsheet

Right now it’s just in alphabetical order, but if I click on the reward column, I can filter these by highest points to lowest points.

Let’s see which credit card is the best for me.

1 Credit Card to Rule Them All

1. Venture X

The best credit card for my wife and I, beyond a shadow of a doubt, using our exact numbers, our budget, is the Capital One Venture X credit card.

We get $867 worth of value from using this card, and that is not including the year one sign-up bonuses. That will be a separate comparison that I’ll do shortly where we can see which credit card is going to be the best for churning if we’re only churning one credit card per year.

2. X1

The second best credit card for us on a yearly basis is the X1 credit card from Robinhood.

We get $788 worth of value. It does not have a signup bonus so it’ll probably go down quite a bit whenever we do the churning comparison. It’s very simple. It just gives you a flat 2 points per dollar spent until you spend $1000 in that month and then every dollar after that will give you 3 points per dollar spent. It’s a pretty cool card.

3. Chase Freedom Flex

The third place card for us is the Chase Freedom Flex.

This is one that’s pretty surprising. We typically do not like the Freedom Flex card because of the flexible categories. But at our spending, the numbers don’t lie. That is a solid credit card.

Credit card ranking from my Ultimate Credit Card Spreadsheet

And you can see there is a theme here. A lot of the top credit cards here are Capital One and most of them are Chase. Chase really delivers. If you go with Chase, it’s very stiff competition.

Why We Love the Venture X

Now that we’ve seen the top 3 credit cards for my wife and I, let’s take a quick look at the number one, the Venture X card, and see where some of these points are coming from.

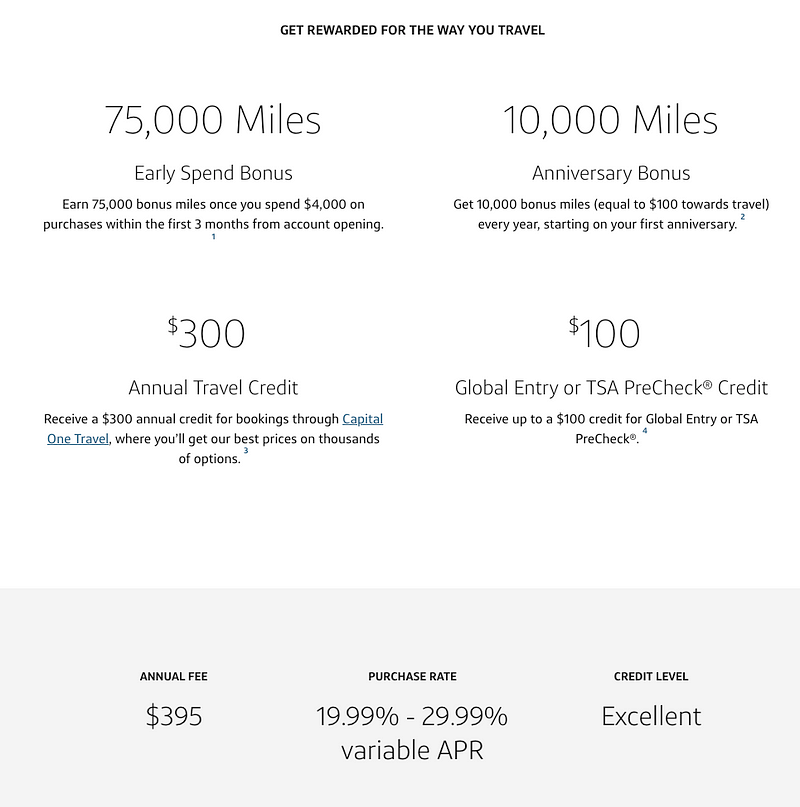

Capital One Venture X rewards and bonuses

Here we can see Venture X at first glance, it looks pretty rough with a $395 annual fee. In most cases, this would scare me away from this card.

But when you look at the annual bonuses, you’re in the green by $130 every year because you get a $300 annual travel credit. You get a $100 anniversary bonus.

Venture X perk calculations from my Ultimate Credit Card Spreadsheet

You get lounge access. When I fly, I like to get to the airport early and eat some food. So I definitely benefit from having access to the lounge where you can get as much food as you want for free. You can even bring some out to your family.

We utilize Global Entry and Pre-check which is a $100 value. And then of course the signup bonus that only counts for year one. We’ll get more into the year one bonuses shortly.

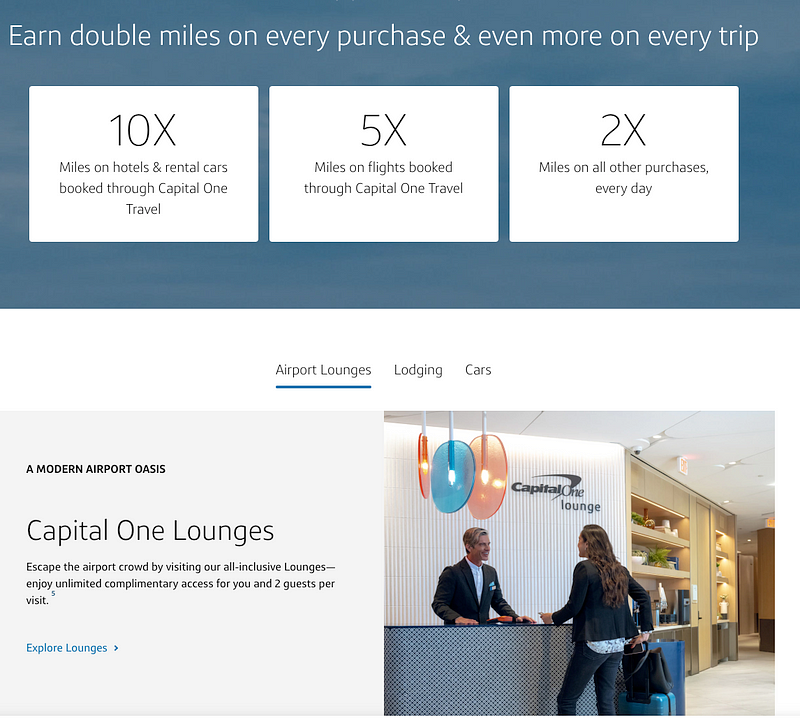

Capital One Venture X points

The points from spending are pretty simple. For the vast majority of your points, you get 2 points per dollar spent. But the more you spend on flights and hotel and rental in the Capital One portal, you’re going to get between 5 to 10 points from those two sources.

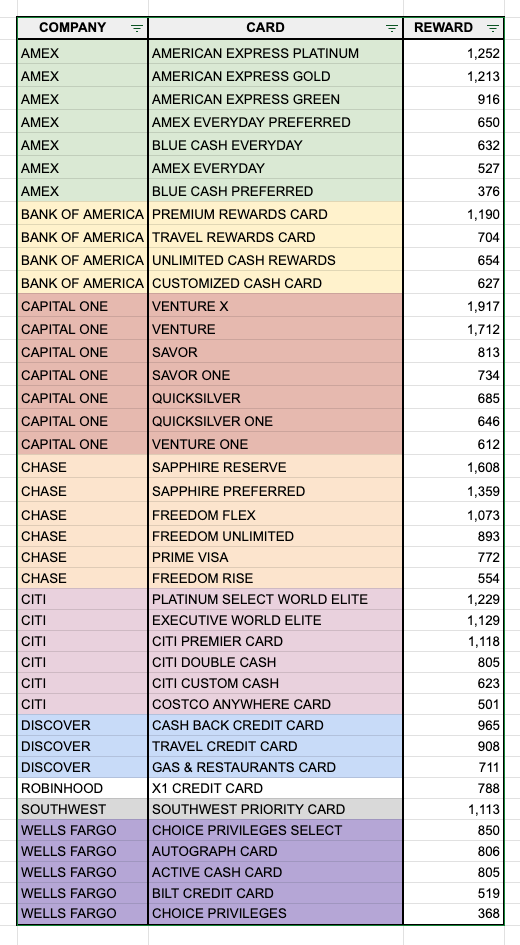

1 Other Credit Card to Rule Them All (for Churners)

The final comparison we’re going to do is for churning credit cards.

Churning is where you open up a new credit card, you take advantage of the signup bonus, and then you close the card or downgrade to a free version of that credit card.

Changing from “0” to ‘1" for first year only

For this analysis, I’ve gone through the user profile section. I’ve put a “1” in the category for first year only. So now it’s taking into account all the different sign-up bonuses at my spending levels.

Credit Card Rankings from my Ultimate Credit Card Spreadsheet

Let’s see which card comes out on top. I can filter the reward by most points to least points.

And once again, the Capital One Venture X comes out on top. So it looks like for my wife and I, there is no debate. The Venture X from Capital One is best for a yearly user and that year one sign-up bonus. It’s a no-brainer. In year one, we get almost $1,700 in value, $1,692.

Second place, we have the Chase Sapphire Reserve at $1,608.

And in third place, we have the other Capital One Venture card at $1,487.

Chase and Capital One are going head to head. They’re neck and neck as they compete to get as many users as they can, and they are making it tough. There are so many good bonuses and so many good points that you can get from these two credit card providers.

The one card to rule them all is, without a doubt, the Venture X credit card. Most points on an annual basis and most points for churning on that year one sign-up bonus. That card is just unbeatable.

The only way to know for sure which credit card is the best for you is to do the math. If you want to use my spreadsheet to do an analysis using your own budget, you can get my ultimate spreadsheet for free.

Or if you do not share my love for spreadsheets, you can check out the other articles in my credit card series. I look at some of the more premium credit card providers like Capital One, Chase, American Express, or Discover and analyze these credit cards at different spending levels. different spending types, and different user profiles, so you can get an idea of where you fit in and which credit card might be the best for you.

Until next time.

Reply