- The Moneycessity Newsletter

- Posts

- READ THIS Before Getting a Discover Credit Card

READ THIS Before Getting a Discover Credit Card

IThe best Discover Credit card is not a very prestigious title. Today, I am going to put the 3 Discover credit cards against each other and give you an alternative superior credit card for each Discover card. We will take into account the points, the miles, the sign-up bonus, and perks to mathematically prove which card is the best for 2024.

When you’re trying to determine which credit card is best for you, you gotta look at:

How much you’re gonna spend in which categories

How much annual bonus that credit card gives you

What kind of signup bonuses are you gonna get with the credit card.

I have put together the ultimate spreadsheet that takes into account all three of these major components for all three of Discover’s major credit cards.

Inthis article, I’m going to show you Discover’s top 3 credit cards: one for travel, one for flexible spending, and one for gas and restaurants. And then I’m going to show you a better card to replace each one.

Let’s get into it.

On the go? Watch my video HERE:

Discover Card Spreadsheet

In this spreadsheet, there are 3 major sections.

Section 1. Credit Card Lineup

This is where I compile all the different credit cards, their annual bonuses, and how many points you get per dollar spent.

1. Discover Cash Back

The first credit card on here is the Discover Cash Back credit card.

It has zero annual fee, which is good, and the signup bonus is a points match. What that means is however many points you spend in that first year, they’re going to match all of them. This is a really good signup bonus if you’re going to spend a lot of money.

Now, in the points that you get from spending, you get 1 point for all purchases, and then you get 5 points per dollar spent if you’re spending in one of the flex categories which change quarterly.

Remember, you have to spend up to $1,500 each quarter to get the full benefit. Any dollar you spend after $1,500, you’re not getting 5 points per dollar spent. You’re going back down to just 1 point per dollar spent.

Let’s check out the cash back calendar and see which of these categories are gonna be easy to hit and which ones are gonna be difficult to hit.

So in this first quarter, we’ve got grocery stores, drug stores, and select streaming services. I think this will be pretty easy to hit in three months. You can definitely spend $1,500 on groceries and drug stores combined, not even including the streaming services.

In the second quarter, we got restaurants and wholesale clubs. Some people have a membership to these. Some people don’t. Spending $1,500 on restaurants though, in three months, I think that’s pretty doable. So two of these quarters, I think I could hit personally.

But in the third quarter, you got to spend on gas stations and through your digital wallet. I personally don’t spend that much on gas. I don’t use a digital wallet, so I wouldn’t be able to hit that quarter.

The fourth quarter is Amazon and Target. Now, I spend some money at Amazon and Target. I think I could probably hit that. The problem is if you’re spending money at these stores, then you’re probably not spending a lot of money at wholesale clubs.

2. Discover Travel

The second credit card we’re going to look at from Discover is their Travel credit card.

This one’s very simple, very easy to calculate how many points you’re going to get. You get 1.5 miles per dollar spent. There’s no annual fee, so that’s really easy. And finally, their signup bonus in year 1 is all the miles you get from your spending get matched. So if you spend a lot of money, you get a big signup bonus.

3. Discover Gas and Restaurant

Discover’s third credit card that we’re going to look at is the Gas and Restaurant card.

This one also has no annual fee once again. That’s the common theme with all Discover’s cards. Just like the others, you get a signup bonus as a points match. Where this card differs from the rest, however, is through the spending. You get 1 point for all purchases and 2 points per dollar spent on gas stations and restaurants. So if you’re spending a lot of money in these two categories, this card might get the edge for you.

Section 2. User Profile

Now I want to look at the second category of this spreadsheet, which is the user profile section.

This is where you kind of dial in what bonuses you’re going to get, and what kind of spending habits you have. That’ll give you a better representation of the points that you get from each credit card.

So if we look at the user profile for me personally, in the flex quarters category, I think I could only hit three-quarters of the spending. So I’m going to adjust that number to 3 and that’ll affect how many points I get at the end of the day from the Flex Spending credit card.

The second two categories I want to look at in the user profile section are gas and restaurants. You put a 1 in that category if you’re going to spend money there. You put a zero if you’re not. For instance, if you drive an electric vehicle, you’re not going to spend any money at gas stations so you’d put a zero in that category to make sure that your spending is not adding up points when you’re not going to benefit from those points.

The final box in the user profile section is the first year only. This is if you want to analyze these cards for churning. Churning is where you open up a credit card and get the signup year 1 bonus and then you close it out. You really don’t care about the points that you get year after year. You’re really only worried about that first year. So I would put a 1 in this category if I want to see which card is the best for churning.

Section 3. Spending Categories

The third section of my spreadsheet is the spending section.

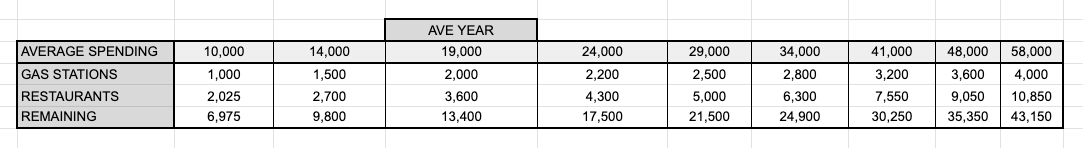

It shows different spending levels and a couple of subcategories for different spending types within that spending level.

For instance, the average American spends about $19,000 per year on their credit card. About $2000 is average for a single person for spending on gas and then $3,600 for spending on restaurants. And then of course the remaining is just those two categories subtracted from the $19,000.

Section 4. Results

The final category of this spreadsheet is the results.

The results section of the spreadsheet has two different representations. We’ve got numerical representation where you can just look across each row and see which credit card has the most points at that spending level. We’ve also got a graphical representation so you can see at a glance where is one card on top and where another card overtakes them.

So first let’s check out the graphical representation. Interestingly enough, the Gas and Restaurants card is on the bottom all the way through at all spending levels. This is clearly the worst card. At the lower spending levels, the Flex Cash Back credit card is on top and right around $35,000, the Travel credit card actually takes over.

Now this would change if we change the user profile section. If you remember, we initially put 3 into the flex spending quarters category. Let’s pop a 4 in there and see how that changes the results.

If you’re able to hit the spending goals for all four quarters, I wouldn’t be able to do this, but if you are, then the Flex credit card would actually be on top all the way up until $48,000 per year, and then only at $58,000 per year would the Travel credit card pass it up. Once again, the Gas and Restaurants credit card is on the bottom. With these spending amounts, you can see it’s really never a good idea to go with the Gas and Restaurants credit card.

Let’s take a look at which credit card is best if you’re just looking to churn these credit cards, get as many dollars as you can in that year one, and then ditch the card after that. After putting a 1 in the first year only box in that user profile section, you can see it really didn’t change anything.

All these credit cards have the exact same signup bonus. You just get a match of your first-year points. So if the card did better before, it’s also going to do better when you’re churning it.

However, you’re about to see in a second, there is always a better credit card than these Discover credit cards. Let’s get into it.

Card Comparision Spreadsheet

I’ve made another tab here on my spreadsheet where I can compare the 3 Discover cards to 3 other cards that I think are similar.

1. Discover Flex Cash Back VS Chase Freedom Flex

The first one I want to look at is the Flex spending credit card from Discover. And I want to compare it to the Chase Freedom Flex.

Right away, you can clearly see the Chase Freedom Flex is better just by looking at the points per dollar spent. You get 3 additional categories on top of the flex category: 3 points per dollar spent on drugstores and dining, and 5 points per dollar spent on Chase Travel. The FreedomFlex is going to outpace the Discover’s points in the points per dollar spent category. It also has a zero annual fee and the signup bonus is $200.

Now this is where the Discover might be able to top the Chase Freedom Flex because if you spend a ton of money with the Discover Flex Cash Back card, you might be able to get a higher signup bonus than the $200.

But the results don’t lie. Let’s look at the results page. And surprise, surprise, the Chase Freedom Flex dominates the Discover Flex at every spending level. With every dollar you spend, the Chase Freedom Flex gets further and further ahead, absolutely crushing the Discover Flex spending card.

But let’s see how it compares when we’re doing churning only. And wow, that is actually very surprising. When you look at year 1 only the Cash Back credit card and the Freedom Flex are right in line with each other, but the Freedom Flex stays on top all the way. Because you get additional points per dollar spent on those other categories, you would always pick the Chase Freedom Flex over the Discover Flex Cash Back card.

2. Discover Travel VS Robinhood X1

The next card I want to show you how to beat is the Discover Travel card. I want to compare it to the X1 credit card from Robinhood.

They both give you just flat points per dollar spent. There are no categories at all. The X1 gives you 2 points per dollar spent on all spending compared to the Discover Travel giving you 1.5 miles per dollar spent. But the X1 gets an additional boost. Once you spend more than $1000 in a month, all additional spending gets you an extra point at 3 points per dollar spent.

Let’s go to the results page though and see how it looks graphically. And surprise, surprise, the X1 starts out on top at $10,000 and as you spend more and more, it gets further and further ahead.

But let’s see if the story changes when we look at the signup bonuses. If I’m looking to churn the X1, it doesn’t get a signup bonus so maybe the Discoverer can outpace it once you factor in that point match. Let’s see.

That is surprising. I would not have guessed this. These two cards are actually giving you points per dollar at the exact same rate. After adding in that signup bonus, the Discover Travel card is actually able to keep up, and it’s just ahead of that X1 credit card.

So if you’re looking for only Year 1, Discover actually takes it over the X1, but every year after that, the X1 is going to be on top by a mile.

3. Discover Gas and Restaurants VS Wells Fargo Autograph

The final card I want to show you how to beat is the Discover Gas and Restaurants credit card. I want to compare it to the Wells Fargo Autograph card.

The Autograph card similarly gets you points back for gas and restaurants. It has no annual fee and it has a signup bonus of $300. Where it starts to take the lead is on the additional spending categories. You get 3 points per dollar spent on travel, restaurants, transit, phone bill, streaming, and gas. Don’t know about you, but I would bet that this card is going to outpace the Discover Gas and Restaurant credit card by quite a bit from these extra categories. Let’s see.

No surprise here. The Autograph card is on top at $10,000 and the gap just widens all the way to $58,000. This one’s a no-brainer. Definitely go with the Autograph over the Gas and Restaurants card from Discover. But once again we gotta check, does that year 1 signup bonus make a difference? Will the Gas and Restaurant card be able to overtake the Autograph from the flat match on all points gained in that first year?

The Autograph card is on top until you hit $48,000 spent. At that point, the Discover does take the lead. It’s pretty clear discover credit cards are not the best in most situations but you can only know for sure if you do the math.

If you’d like to use my spreadsheet to do your own analysis using your own budget to see which credit card is best for you, click here to copy it for free.

Or if you do not share my love for spreadsheets, you can check out the other videos in my credit card comparison playlist where I go over some of the more premium credit card bonuses like Capital One, Chase, and American Express. You’ve already got a taste of these, but you have not seen the best ones yet.

Until next time.

Reply