- The Moneycessity Newsletter

- Posts

- WARREN BUFFETT On Selling Put Option Strategies

WARREN BUFFETT On Selling Put Option Strategies

What is Warren Buffett's options trading strategy? By delving deep into his annual letters to shareholders over 46 years, I found that Warren Buffet's options plays are not as common or straightforward as portrayed contrary to popular belief that Buffett is a prolific options trader.

I read through all of Warren Buffett’s annual letters to shareholders where his options plays are explained.

I went back 46 years and searched through hundreds of pages and it is not what I expected to see.

When I type in “Warren Buffet options” into Google, I see link after link of articles like “How to use options to invest like Warren Buffet”, “Warren Buffet’s approach to options trading”, and “Warren Buffet’s Sleeper Strategy: Trading Options for Income”.

After reading the headlines, it is easy to come away with the idea that Warren Buffet is a prolific options trader, specifically selling put options.

After clicking through all the top links, I find two major claims about Warren Buffett’s prolific options plays.

The first one made him millions, and the second one actually made him billions.

Let’s start with the first one.

Watch the video version HERE.

The Coca Cola Put Options Play

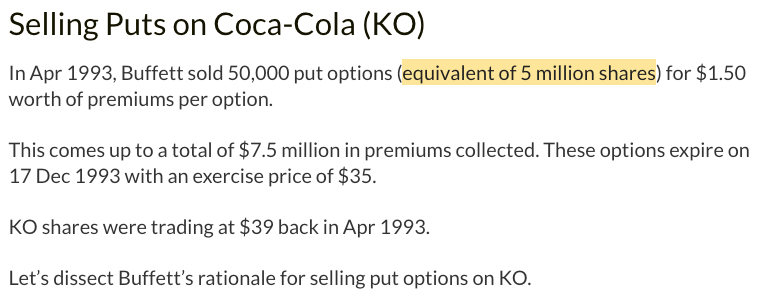

The first play is Warren Buffett selling puts on Coca Cola.

In 1993, Warren Buffett wrote put options to purchase Coca Cola at a price of $35 per share when the current market price was $40 per share.

Now, to be clear, the details of this trade was not in the annual letters to shareholders, but since there are so many articles talking about this trade in particular, I’m going to assume it to be true.

For context on put options, the buyer of the option has the ability to sell shares of a stock to the seller of the put option for an agreed upon price within an agreed upon amount of time.

Options Trading Explained — Illustration by author

The buyer isn’t obligated to sell the shares though.

For instance, if the market price at the expiration date of the option is higher than the agreed upon price, then the buyer of the option would just sell their shares on the open market.

The time when they would benefit is if the price dropped on the company in question, in this case Coca Cola, and then the buyer was able to sell their shares for above the market price.

In Warren Buffett’s case, he sold the put options with a strike price of $35 because that is the price he was willing to pay for Coca Cola.

Options Trading Explained — Illustration by author

If the price dropped below $35, he would get his deal. If the price stayed above $35, then he would get to keep the premium that he sold the put options for, in this case $1.5 per share.

Options Trading Explained — Illustration by author

When I first read through the details of this trade, I thought it was a pretty big deal because his put options were for 5 million shares. Multiply that by $1.5 and you get a premium of $7.5 million just for the opportunity to buy shares at a better price.

In this case, since Warren Buffett didn’t actually have to buy the shares, he just got to keep the $7.5 million.

How Buffet Uses Options

To an average guy like me, $7.5 million is a lot of money until I looked at Berkshire Hathaway’s Coca Cola Holdings in 1993.

Berkshire Hathaway’s Letter to Shareholders 1993

In Warren Buffett’s letter to shareholders, he states that Berkshire Hathaway holds 93.5 million shares of Coca Cola. Adding an additional $5 million shares would represent a very small increase. Especially after 3 years, in 1996, Berkshire Hathaway increased their Coca Cola holdings up to $200 million shares.

Berkshire Hathaway’s Letter to Shareholders 1996

At least in this case, entering a new position using put options does not represent a significant strategy for Warren Buffett.

You would get much better returns by clapping for this article.

The Four Equity Indexes Play

What about the second example of Warren Buffett selling put options, the example where he made billions?

Between 2004 and 2008 Warren Buffett sold put options on four different equity indexes: the S&P 500 in the US, the FTSE 100 in the UK, the Euro Stoxx 50 in Europe, and the Nikkei 225 in Japan.

The contract total was worth $37 billion.

Berkshire Hathaway’s Letter to Shareholder 2008

That is the amount of money that Berkshire Hathaway would need to have on hand to cover their liabilities should all of the contracts execute their right to sell shares to Berkshire Hathaway for a total of $37 billion.

Put another way, the maximum loss would be $37 billion if all of the underlying assets went to $0 because the seller in this case, Warren Buffett, would be forced to buy worthless shares of stock for the agreed upon price totaling $37 billion.

On the surface, this seems like a lot of risk, especially when you consider Warren Buffett is a guy that’s famous for saying: “The number one rule of investing is don’t lose money and the number two rule of investing is don’t forget rule number one.”

Surely, Warren Buffett is not a degenerate gambler. We have to dive into the details of the trade.

In his letter to shareholders in 2009, Warren Buffett revealed that he received $4.9 billion in premiums. Now that is a significant sum of money.

Berkshire Hathaway’s Letter to Shareholder 2008

Warren Buffett’s Options Are Built Different

So that answers my question, right?

Warren Buffett does trade options in a big way and the implication from all the articles is true: I should also sell put options.

Actually, no.

There is a huge game changer, and a very important detail in Warren Buffett’s strategy that does not show up in any of the articles that I read.

You have to look into his annual letters to shareholders.

Berkshire Hathaway’s Financial Statement 2009

Warren Buffett has one thing that an average guy like me does not have: a AA+ rating from Standard & Poor.

Berkshire Hathaway was able to write $37 billion worth of put options without having to put up $37 billion in collateral. By the end of 2008, Warren Buffet had only $550 million in collateral.

I cannot get over how insane that is.

Options Trading Explained — Illustration by author

If I personally were to write $37 billion in put options, I would have to have $37 billion set aside in the bank to cover if the buyers of those put options were to execute their trade.

The opportunity cost of not having all of that money invested in the market would be massive.

For instance, the S&P 500 has an average annualized return of about 10%. 10% on $37 billion is $3.7 billion per year. That is a huge cost that Warren Buffett is able to skip out on.

So not only did Berkshire Hathaway need very little collateral, just $550 million. They also were able to get $4.9 billion in premium for their trouble which Warren Buffett was able to start investing immediately.

But wait, there’s more.

Warren Buffett’s Options Through 2008 Crisis

You might be wondering: how did Buffett not get absolutely wrecked by the financial crisis at the end of 2008?

I mean, this had to be the worst time to sell puts.

The S&P 500 dropped by nearly 50% from its height at the end of 2007 down to the bottom at the beginning of 2009.

Well, Buffett’s options are built different.

Options Trading Explained — Illustration by author

On top of requiring almost no collateral, these were European style put options, meaning that the buyer cannot execute the deal until the day the contract expires.

When most people, including myself, think about selling put options, we’re thinking about American style options, meaning the buyer of the option can execute the trade at any time.

In Warren Buffett’s case, if they were American style puts, then the buyer could have executed those options, forcing Buffett to buy their shares at 50% if they timed it at the bottom of the S&P 500.

Options Trading Explained — Illustration by author

So his options couldn’t be executed early, but he also bought options as early as 2004. Would those also be saved?

I mean, he would need an expiration date 5 or 6 years out maybe. In my experience, when I’m looking at selling puts, I generally see the longest expiration dates of 2 to 3 years out.

What was the details?

Berkshire Hathaway’s Financial Statement 2009

This is ridiculous.

I have never seen a put option with an expiration date of 20 years.

So What Now?

So all those articles are BS.

Warren Buffett is not a prolific options trader. At least not in the way that these articles would imply.

When average investors like myself are asking the question “Does Warren Buffett trade options?” We’re not talking about 15 to 20 year put options with $0 collateral.

It’s just not applicable to the average investor.

And sure, Warren Buffett did sell some American style put options with an expiration date of about a year, give or take, but this was just a tiny percentage of his total holding. Just one holding, by the way (the type of play I’m talking about is the Coca Cola play).

Warren Buffett prefers a buy and hold strategy above all else, and he tends to invest in companies that pay a dividend which for me is great news because a buy and hold strategy is like the least complicated strategy out there. And I do not need to be an expert stock picker like Warren Buffett.

In my opinion, one of the easiest ways to gain exposure to quality dividend companies is to invest in the right ETF. Click HERE where I go over the four steps that I use to pick dividend growth ETFs that outperform the S&P 500.

Catch on the flip side.

Reply