- The Moneycessity Newsletter

- Posts

- If You are Too SCARED to Invest in Stocks, Read This

If You are Too SCARED to Invest in Stocks, Read This

The thought of investing at the worst possible time scares many from investing altogether. However, a market crash isn't the only way to lose money. Not investing is a strategy that carries its own unique risks.

On the go? Watch the video HERE.

Harold started investing at one of the worst possible times in history.

Yahoo Finance — S&P 500

He worked up the courage to put his money in the S&P 500 in 2000 just as the dot com bubble was about to pop. The stock market crashed by nearly 50% over the next two years, and Harold continued to faithfully invest every month as the stock market continued to decline.

Seven and a half long years later, the market returned to the level where Harold started his investing journey. He is back to square one as 2007 is coming to a close until he gets cooked once again by the next market crash. The financial crisis of 2008 sent stocks plummeting by over 50% this time, lower than they were before.

But Harold would continue to invest every single month. And finally, in the year 2013, thirteen years after Harold started his investing journey, the stock market returned once again to where Harold started but he is only back to square one once again.

I didn’t want to be Harold.

What If I Invest at the Worst Possible Time?

I compiled the monthly prices of the S&P 500 and the dividends from 2000 to 2013 assuming Harold invested $100 every month that whole time.

After thirteen years, he had invested roughly $16,000 into his investment account but his account balance was $24,891. He had a gain of roughly 56%, or $8,891 even though his starting point and his ending point thirteen years later were the exact same.

Yahoo Finance — S&P 500

At first, this seems crazy until we remember that Harold did not invest all of his money at the tippy top of the stock market. That’s just not how people do it. It’s very rare to invest a huge lump sum of money all at once. People normally spread it out over many years, investing a small amount every week, every month consistently.

Yes, Harold put in $100 at the very top, and that particular $100 bill did not make him very much money other than dividends over thirteen years. But then the second investment he made started at a little bit of a lower price, and it made some money. And the third investment made a little more still, and he invested all the way down to the bottom.

Yahoo Finance — S&P 500

And those investments at the bottom of the curve made Harold a lot of money enough to make up for the fact that his investments at the top at a few key moments didn’t make him very much. In reality, there were very few times that Harold actually invested at the very top of the market. Most of his investments did, in fact, make money.

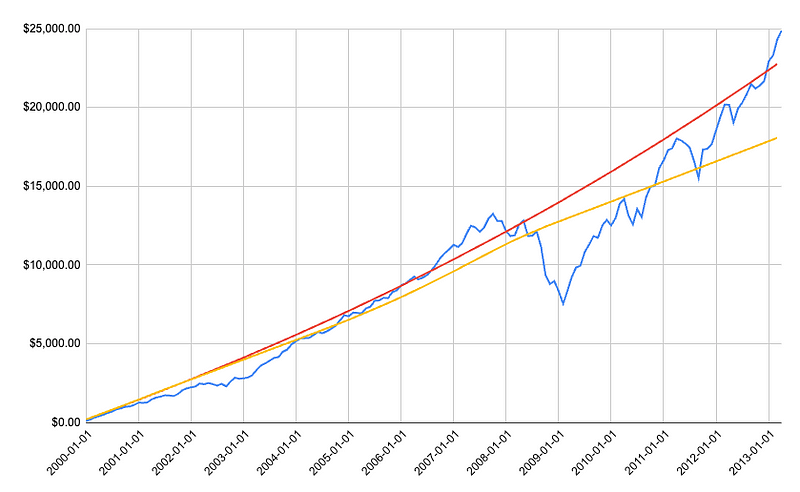

Would a Savings Account Have Done Better?

What if Harold found a 5% yield savings account? How much would he have ended up with if he just put it in there and made 5% the whole time? Would the stock market have kept up with a 5% constant yield?

The answer is yes, and then some.

Harold would have ended up with $22,775 with 5% yield in his savings account the whole time. The stock market outperformed a constant 5% yield by over $2,000.

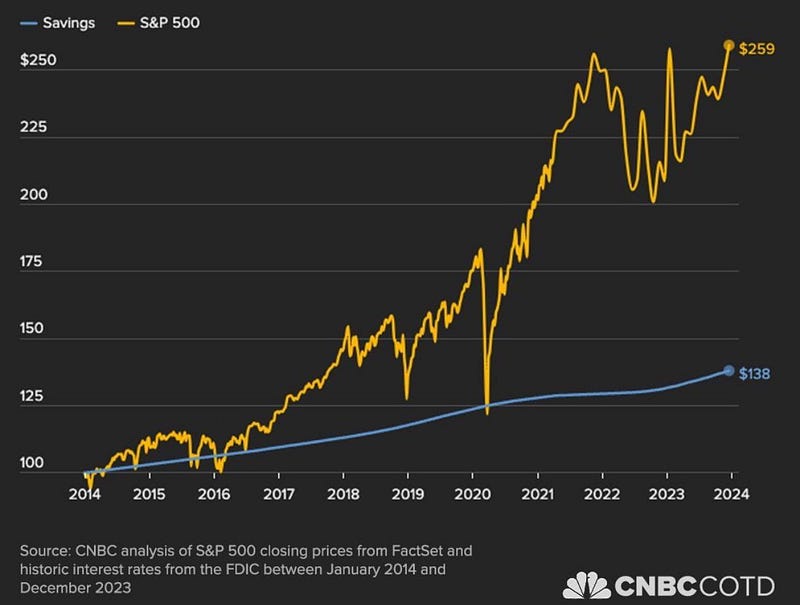

Investing in the S&P 500 versus Savings Account

On top of that, it gets worse because there’s no such thing as a savings account that yields 5% indefinitely. In reality, the percent yield that a bank offers is related to the federal funds rate.

Here is a great Reddit post where somebody cataloged the rates that they received from their Ally Savings account and compared them to the federal funds rate.

Ally Bank Interest Rate VS Federal Fuds Rate

Yes, the yield does have a slight lag, but it follows the federal funds rate very closely. In this post, he does show that his minimum rate was 0.5% even though the federal funds rate dropped much closer to 0%, Ally Bank never dropped their yield below 0.5%.

So in my Excel spreadsheet, when I adjusted the real savings account to follow the federal funds rate and capped the minimum savings account yield at 0.5% to make this more in line with reality, I would end up with $18,080 after 13 years using a realistic savings account that would lose to the stock market by nearly $7,000.

S&P 500 (Blue) versus Ideal Savings Account (Red) VS Realistic Savings Account (Yellow) from 2000 to 2013

Of course, the disparity between the stock market performance and the savings accounts grows even more if we let Harold invest even further into the future. From 2013 all the way to 2024, the stock market went on a pretty good bull run. Investing just $100 every month, a total of $30,000 of his own money, and it would have grown to $140,000.

S&P 500 (Blue) versus Ideal Savings Account (Red) VS Realistic Savings Account (Yellow) from 2000 to 2024

As we can see, the stock market outperforms the savings accounts by tens of thousands of dollars.

Even if we started our investing journey at the worst possible times in history, we would still come out on top if we just stay invested and keep consistently investing.

So What Now?

If you’re hesitant to get started, just put $100 a month in the stock market. A little bit at consistent time intervals is a strategy known as dollar cost averaging.

On the other hand, investing a lump sum of cash all at once can be quite scary. Check out this video HERE where I go over a story where this strategy went absolutely horrible for somebody losing hundreds of thousands of dollars overnight and you can learn how to avoid that outcome yourself.

Catch you on the flip side.

Reply