- The Moneycessity Newsletter

- Posts

- If You Are LOSING MONEY Selling OPTIONS, Try This

If You Are LOSING MONEY Selling OPTIONS, Try This

Is selling options risky and most importantly, when should you sell options instead of buying stocks? I have been selling options for the past 5 years and have learned my fair share of lessons. I am sharing my experiences with selling options for income in the context of total returns and situations where I find selling options beneficial.

Selling options for income is a very tempting prospect.

When it works, it feels good, but when it doesn’t, OMG is it brutal.

I am not saying that selling options doesn’t have a place in a rational strategy, just that the old wisdom of income generation is dubious.

I have been forced to relearn the same lesson a few times now, and I had to learn it the hard way.

It is all about total return.

It does not matter if I get my returns from dividends, from capital gains, or from premiums from selling options contracts.

I’m going over what I’ve learned from selling options contracts: both my successes and my failures.

On the go? Watch the video HERE.

Let’s get into it.

Most Common Option Strategies

The two most common strategies used to get income by selling options is:

Cash secured puts

Covered calls

Some combination of the two (more on this later)

Cash Secured Puts

Selling a cash secured put generally gives the seller a premium for writing a put option with a strike price just below the current strike price.

The best returns are normally seen when the stock price stays pretty much flat or goes slightly up or slightly down, but not down enough to trigger the strike price.

Cash Secured Puts Illustration by author

Covered Calls

Covered call options have nearly the exact same return profile except I would buy the underlying shares instead of using cash to secure the option.

After buying 100 shares, I would sell a single call option with a strike price just above the current stock price.

Covered Call Illustration by author

Personally, I prefer the covered call over the cash secured put because I get a return in three different ways.

I get to retain access to the dividend. If the underlying stock pays a dividend. You don’t get that with the cash secured put.

I get the premium associated with selling the call option.

I get access to the appreciation in stock price because when I write the call option, I set the strike price just above the current stock price.

Just like with the cash secured put though, the covered call is similar to the cash secured put in that it works best when the stock price stays roughly flat.

However, this is the core of the problem.

The market tends to have the majority of its gains concentrated in just a few trading days, and the same is true for market losses.

This graph shows the historic returns of the S&P 500.

Historic Returns of S&P 500 during Bear Markets and Bull Markets

The first bar shows my return on $10,000 if I stayed invested over the whole time period.

The second bar shows what my return would be if I missed out on just the best 10 trading days.That’s just 10 days over a 30 year period and I miss out on 54% of my total returns.

And of course it just gets worse if we miss out on the top 20 days or if we miss out on the top 30 days.

If I am consistently using covered calls or cash secured puts instead of just owning the underlying stock, then I am guaranteed to miss out on the biggest returns and I still get wrecked by the worst trading days.

Because of this concentration in market returns, I am not a fan of consistently using the cash secured puts or the covered calls to generate income because you just flat out end up with a lower total return.

That being said, there are three situations that I like to use cash secured puts and covered calls, and I’m going to go from most responsible to most degenerate.

Situation 1: Entering a New Stock Position

The first situation is entering a new stock position and I can use either a cash secured put or a covered call to make this happen.

Let’s say VOO Vanguard’s S&P 500 index fund is around $470 at the moment.

If my target entry price for VOO is $465, then I’ve got two options:

I can either wait for the price to drop and then I can just buy in.

I can sell options in the meantime to collect some premiums.

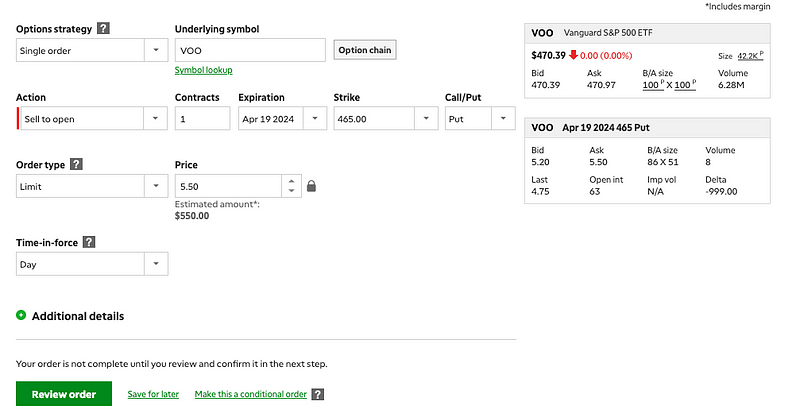

Here I have set up two potential trades.

Cash Secured Puts

First, with the cash secured put, I will need $46,500 to secure the put with a $465 strike price. However, accounting for the $550 premium, I will be able to enter that position for $45,950 assuming the stock price drops to $465.

Cash Secured Puts Trading Example by author

Covered Calls

Alternatively, I can set up a covered call trade where I am simultaneously buying 100 shares at the current price and selling a call with a $465 strike price.

The premium I get from selling the call will lower the cost basis of the trade and I will be able to enter this position for $45,897, slightly better than a cash secured put with the same outcome.

I will only end up with the shares if the price drops below $465. Also, if there are any dividends at the time, I will benefit from that as well.

Covered Calls Trading Example by author

For the first situation, entering a new stock position, I definitely prefer the covered call. I really like being able to have access to the dividend and you get a slightly better premium.

Situation 2: Exiting a Stock Position

The second situation where I like to sell options is when I’m exiting a stock position.

If my plan is to sell my shares of stock at a specific price, then selling a call option at that strike price works very well.

Let’s say VOO is currently at $450 per share and my goal is to sell when it reaches $500. Perhaps I think VOO is overpriced at $500 per share, or maybe I have a specific savings goal.

What I would do is I would sell a call option with a strike price of $500 and collect a premium while I wait for it to hit that number. Then I would take that premium and buy additional shares with it.

That way I’m simultaneously increasing the number of shares that I have and reducing my price per share. Since my share count is slowly increasing, I could theoretically reduce my target sell price and still make the same profit or more.

Covered Call Strategy Illustration by author

With this strategy, I will hit my savings goal faster than just selling the shares traditionally. Although I do run the risk of missing out on additional gains if the share price of VOO dramatically increases before my call option will expire.

However, if you set up an automatic sell at $500, I would really run the same risk anyway. I genuinely struggle to think of a case where traditional selling beats out selling a call option. If you have a good example, though, let me know in the comments.

In any case, selling a call option greatly outperforms just traditional selling if the share price does not dramatically exceed the strike price.

Situation 3: High Volatility

The third situation where I like to sell options, which is also the most speculative is when volatility and implied volatility are very high which dramatically increases the value of premiums.

Historic Volatility VS Implied Volatility

Historic volatility refers to how much the price has moved in the relative recent past, while implied volatility refers to the future expected price movement of a stock.

If a company has an earnings report coming out in the next few days, the implied volatility will be much higher for options that expire after that report comes out.

If the Fed is about to announce a potential rate hike or rate cut, then that will have a huge impact on implied volatility for ETFs like the S&P 500 or even individual companies that make up the S&P 500.

My strategy of choice around earnings reports is what’s known as a diagonal spread.

Diagonal Spread

Here is how I would do it.

First, I would sell a call option out of the money with an expiration date 1 or 2 weeks after earnings.

Then, instead of covering that call option by buying 100 shares, I would cover it by purchasing a second call option. The second call has a strike price just $1 greater and an expiration date slightly further out than the call that I sold. That way my maximum loss is just $100 instead of the amount of money that I would have to put forward to buy 100 shares of the underlying stock.

Due to the high volatility, I would be able to enter this position with a $15 to $30 credit. Without the high implied volatility, you would generally have to enter a position like this for a debit.

Diagonal Spread Illustration by author

There are generally four typical outcomes that I experienced when I make this play.

If the share price drops significantly after the earnings report, then both the call option that I bought and the call option that I sold would expire worthless and my profit would be limited to the $15 or $30 premium that I gained when I entered the position.

If the share price goes way up past the strike price of both my call options, then I will likely lose $75. The reason I won’t lose the full $100 is because the option that I bought will have more time value left on it than the option that I sold.

The situation where I receive my maximum loss is when the call option that I sold gets executed, which forces me to buy 100 shares on margin. If the call option that I bought is still above the strike price, then I am forced to execute that call option in order to pay back the shares that I had to borrow. This situation is rare, but it has happened to me.

Finally, the situation where I experienced my maximum gain is when the stock price does not quite reach the strike price of my short call option. That way, that option expires worthless, and then the long call option I’m able to sell for additional gain.

The maximum gain that I have received using this strategy is $300 on a single play. However, the most common scenario is a $15 to $30 gain just from the premium.

This strategy also works the same way with put options, but I tend to get better results using call options.

Admittedly, diagonal spreads are probably a little closer to gambling than they are to responsible investing. When it comes to income, I am more comfortable using a dividend growth strategy in my tax advantaged accounts like my 401k, HSA, or IRA.

If you’re interested in learning how to invest in dividend growth ETFs, click HERE to check it out. Or if you want to know which tax sheltered account is the best, check out this one right HERE.

Catch you on the flip side.

Reply