- The Moneycessity Newsletter

- Posts

- Should I Buy NVIDIA Now or Wait | NVDA Stock Analysis 2024

Should I Buy NVIDIA Now or Wait | NVDA Stock Analysis 2024

NVIDIA has been absolutely popping off since the beginning of 2023 and I'm upset that I've missed out but Is it too late to jump on the train? To answer that question, I have poured over the last 24 quarters of financial statements, read through expert analysis, and researched the single greatest explosion in NVIDIA's revenue, so you don't have to. I'm going to share what I have learned about what the heck happened with NVIDIA and what I plan to do about it.

NVIDIA has been absolutely popping off since the beginning of 2023 and I’m upset that I’ve missed out but Is it too late to jump on the train?

To answer that question, I have poured over the last 24 quarters of financial statements, read through expert analysis, and researched the single greatest explosion in NVIDIA’s revenue, so you don’t have to.

I’m going over what the heck happened with NVIDIA and what I plan to do about it.

On the go? Watch the video HERE.

Let’s go.

NVIDIA Revenue Sources

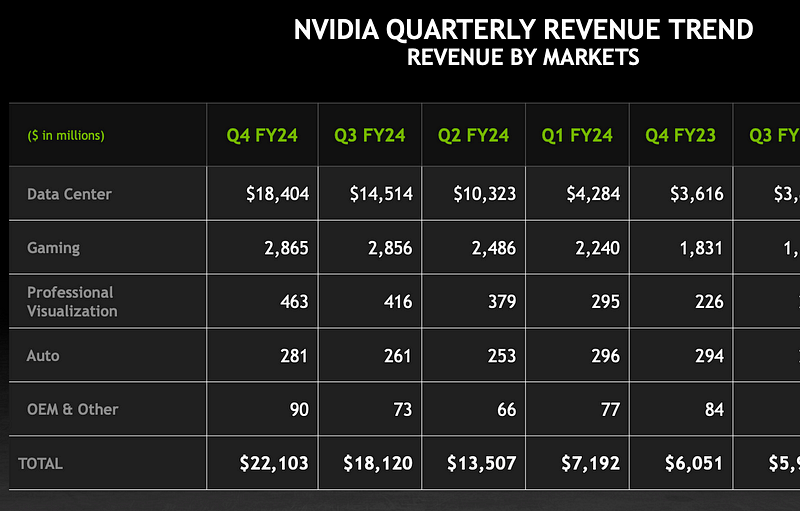

The primary reason for NVIDIA’s growth becomes immediately obvious when you just look at the last quarter revenue breakdown.

Remember when NVIDIA was a gaming graphics card company?

Well, things have changed. Gaming now only makes up 13% of NVIDIA’s revenue, while data centers make up a staggering 83%.

NVIDIA Quarterly Revenue Trend in 2023 and 2024

To get a better feel for how things are changing, I decided to compile the last 6 years of revenue breakdowns right here.

If I squint, I can see there are a few lines jumbled up there at the bottom. You can still see gaming revenue, but the revenue from data centers renders the rest of this chart worthless.

NVIDIA Revenue by Quarter from 2019 to 2024 — graph by author

While the data center revenue did technically take the lead over gaming in the 2023 fiscal year, that was largely because the gaming revenue dropped off. The real pop off didn’t hit the revenue numbers until Q2 of the 2024 fiscal year, which ended on July 30th, 2023.

In just one year, the revenue from data centers multiplied by 4x.

Next, I decided to remove the revenue from data centers from the chart, so I could actually see some of the other lines and the chart feels very different.

NVIDIA Revenue by Quarter from 2019 to 2024 — graph by author

The through line is still roughly positive, but I think this really highlights where the real growth in the stock is coming from.

To understand NVIDIA’s through line, future growth prospects, I need to understand the data center game.

And this is where I found the juiciest intel.

But before I could truly appreciate the risks that I uncovered about data centers, I need to first understand what does the current price imply about NVIDIA’s growth?

NVIDIA Financial Health and Market Expectations

What does the current price promise?

Currently, the trailing 12 month price to earnings ratio of NVIDIA is over $75. This, among other things, earns NVIDIA a valuation score from Seeking Alpha of F — Fail.

This looks bad, but I’m really not that interested in the trailing 12 months of earnings from a company who’s recently undergone massive changes.

To illustrate this point, check out this chart, which shows the trailing 12 month PE ratio next to the earnings per share and next to the corresponding stock price over time.

NVIDIA PE Ratio, Earnings per Share, and Stock Price from 2010 to 2024

In April of 2023, you can see that the TTM, trailing 12 month PE ratio, exploded to nearly $150.

If I was only looking at this number to determine whether this was a good time to buy, then I would be missing big time because the future prospects of NVIDIA at this time were huge.

The whole market expected them to break into the data center game. And this time the market was right.

The TTM PE ratio dropped back down quite a bit, even though the stock price popped because the earnings caught up to the market expectations.

Don’t get me wrong, I would prefer a lower TTMPE ratio right now if I was going to invest.

The information technology sector median for this number is 28.75, so NVIDIA is really high at 75.74. What that means is that the market expects NVIDIA to continue growing at a rapid rate.

That being said, in this case, I think it is better to look at the forward PE ratio, which is also high, 39.2 in this case compared to the sector median of 28.75. So even with the forward looking PE ratio, NVIDIA is still 36% higher than the rest of the sector average.

NVIDIA Forward PE Ratio vs. Trailing PE Ratio in 2024

The forward PE ratio isn’t perfect either because nobody knows 100% what’s going to happen in the future. But at least this number is attempting to take into account new information while the TTM PE ratio is not.

And this is especially important when the company is making massive changes to their business model.

So the question is, what does the current NVIDIA stock price imply about NVIDIA’s future?

NVIDIA Growth Projections and Analyst Opinions

What does the market believe will happen?

On Seeking Alpha, we can see that 45 analysts chimed in for the fiscal year ending in January of 2025. And there was a variety of opinions.

NVIDIA Analyst Prediction for Earning per Share and Revenue from 2025 to 2034

The average projected year over year growth was 91.5%, which is huge, and corresponds to an earnings per share of $24.81. The low end projection for earnings per share is $22.3 and the upper end is $30.78.

So between $45 professional analysts, the range of expected growth over the next year is between $72 and 137%.

This is really good growth and pretty good consensus, but for the following year, projections drop off big time and the range of possibilities widens.

For the year ending in January of 2026, 43 analysts’ average projected year over year growth drops to 21% from from 95% in the year before with a high end estimate at 69% growth and a low end loss of 19%.

So we have 69% all the way down to negative 19%. That is a huge gap.

They are all over the place. It’s about as bad as a weather forecast. There’s no wrong answers. I feel like I could be qualified to do this.

After year two, the estimates get even more wacky. Clearly, there is a lot of uncertainty over the pace of NVIDIA’s revenue growth, specifically in reference to data centers.

But, the current stock price does not reflect uncertainty. The current stock price reflects exuberant growth. It’s very positive.

If I invested in NVIDIA today and wanted to see an average annualized return of 10% for the next 10 years, then the share price in 10 years would have to be $2,330 and the market cap would be $5.8 trillion.

NVIDIA Future Value in 2034

If at that time, the trailing 12 month PE ratio was in line with the sector median, then we would expect an earnings per share of $100.

NVIDIA Price per Share, Earnings, PE Ratio, Earning per Share, Market Cap, Share Outstanding, and Revenue in 2034 — Spreadsheet by Author

If I assume that profit margins will be roughly the same, then we’re looking at a yearly revenue of about $530 billion.

This is how the market has priced NVIDIA.

NVIDIA Annualied Return and Percent Return in 2034

If I use the analysts’ estimates for growth on Seeking Alpha, smoothed out of it because in year 3 and 4 they get a little bit all over the place, they would project a revenue after 10 years of $350 billion and would suggest a share price of $1,530 as opposed to $2,330.

If after 10 years, the share price only increased to 1, 530, then I would have received an average annualized return of 5.5% if I bought today. So that is not very good considering the market average is about 10%.

Clearly, the market is very optimistic about the future of NVIDIA. If anything goes wrong, if anything happens negatively, then the market will very quickly adjust the price of NVIDIA down.

NVIDIA Risk Factors

The next question I need to answer is what are the chances that something will go wrong with NVIDIA’s data center revenue?

Currently, NVIDIA is in a dominant position and has a huge percentage of the market share. Wells Fargo Equity Research estimates that NVIDIA has 98% market share on data center GPUs. That is massive.

Not only does NVIDIA have the most mature technology offering AI with arguably the best chips, they also have the best software CUDA.

NVIDIA has spent more than a decade fixing issues and dialing in CUDA while the rest of the competition is really just getting started.

Certainly, NVIDIA is primed to maintain its ridiculous market share in the short term. But in the long term, I’m not so sure.

And the analysts are not either.

There are two major risk factors that could decimate NVIDIA’s data center revenue.

Risk #1: Manufacturing Threat

The first one can be found on their 10K form under risk factors: risks related to demand, supply, and manufacturing.

Specifically manufacturing.

NVIDIA Risk Factors from Form 10K

NVIDIA is highly dependent on Taiwan Semiconductor Manufacturing Company for the manufacture of their silicon chips.

NVIDIA Relationship with Taiwan Semiconductor Manufacturing Company

Furthermore, NVIDIA’s CEO believes it will take 20 years for the US to become self reliant on chip manufacturing. So for the next 20 years, if something happens to Taiwan, something is going to happen to NVIDIA.

China On Track to Invade Taiwan

Meanwhile, China has become more and more aggressive towards invading and taking Taiwan. The latest analysts show China is on track to be ready to invade by the year 2027.

Of course, we’ve been hearing this kind of talk for many years now, but it is still a risk factor. The 10 year plan for NVIDIA would be destroyed if China decided to invade Taiwan.

Risk #2: Customer Competition

The second risk factor is competition.

There are some articles floating around that suggest AMD will slowly progress and take some market share here and there, but that’s not the kind of competition I’m worried about.

AMD vs NVIDIA Market Share

Competing with NVIDIA for NVIDIA’s customers is not easy. But what if it’s NVIDIA’s customers who are competing with NVIDIA for their own customers business?

It would be like if you’re trying to sell me hot dogs, but I’m starting to make my own hot dogs. Uh, I think I’ll just eat my own, right?

Currently, 40% of NVIDIA’s data center GPU revenue is split between just four customers: Microsoft, META, Amazon, and Alphabet or Google.

However, all four of these companies have plans to start making their own in-house chips.

1. Microsoft: 15% of NVIDIA’s data center revenue

Microsoft vs. NVIDIA Market Share

“Microsoft is tapping into semiconductor pioneer, Intel, and its ambition to make more chips as it races to develop further AI models. For Intel, partnering with Microsoft, one of NVIDIA’s biggest buyers of AI chips, will boost its made to order chip business as it competes with other leading chip makers, such as Taiwan Semiconductor Manufacturing Company and NVIDIA itself.”

2. META: 13% of NVIDIA’s data center revenue

META vs NVIDIA Market Share

This article was dropped on February 1st of this year. “META plans to deploy into its own data centers this year a new version of a custom chip aimed at supporting its artificial intelligence push according to an internal company document.”

3. Amazon: 6.2% of NVIDIA’s data center revenue

Amazon vs NVIDIA Market Share

This article by the New York Times states that Amazon invested $4 billion in the AI startup Anthropic for the purpose of producing AI specialized chips designed by Amazon.

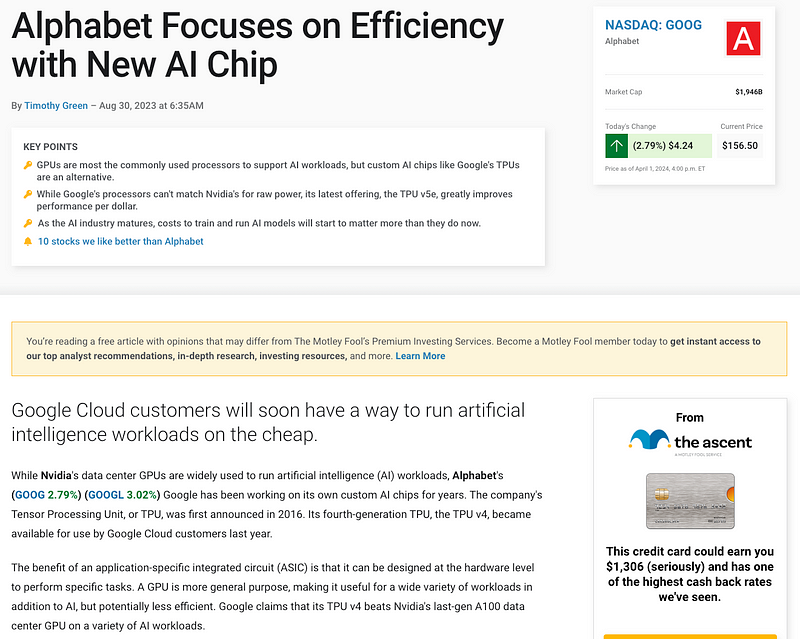

4. Alphabet: 5.8% of NVIDIA’s data center revenue

Alphabet (Google) vs. NVIDIA Market Share

They have been working on their own custom AI chips for years. The company’s Tensor Processing Unit, or TPU, is in its fourth generation.

The worst case scenario here is that not only does NVIDIA start to lose 40% of its market share to its own customers, but the remaining customers start to lose market share because competition as a whole starts to increase.

At the very least, NVIDIA would start to lose its pricing power if they are no longer the only effective option.

My Investment Strategy for NVIDIA

So here’s my plan.

I think that NVIDIA will remain strong in the short term, but in the long term, I think the odds are stacked against them.

Therefore, I will not be buying any shares of NVIDIA at this time.

Currently, all of my speculation funds are tied up in an election related stock prediction, but this plays into my favor.

The best thing to do is wait out the short term while NVIDIA will probably continue to go up a bit as markets fail to take into account the risks related to the data center revenue.

And then, if conditions are right, I’m going to be looking at a long-dated calendar put spread. But there’s a lot of things that can happen between now and then.

But in the meantime, if you’re interested in seeing my election related stock prediction, check out this video HERE or read the article HERE where I’m going after a 10X gain if the market does what I think it’s gonna do.

Catch you on the flip side.

Reply