- The Moneycessity Newsletter

- Posts

- The Truth About NVIDIA Stock Price

The Truth About NVIDIA Stock Price

Investing in NVIDIA has made people very rich in the past but now is not the time to jump in. I analyze NVIDIA's current share price using the discounted cash flow model and consider the biggest risks to future growth.

Now is NOT a good time to buy NVIDIA stock.

On the go? Watch my video HERE.

Discounted Future Free Cash Flow

For this analysis, I’m using the discounted future free cash flow model. I love this model because it’s very intuitive and easy to understand.

Free cash flow is the money that a company uses to pay off its debt, invest in future growth, pay dividends, or perform share buybacks. Basically, the free cash flow is my investment return. I don’t care about the earnings per share as much as I care about the free cash flow per share.

I want to know:

How much free cash flow a company is generating right now?

How much they’re expected to grow that free cash flow in the future?

NVIDIA’s past and current free cash flows are easy to find in their financial statements but future free cash flows are a different story. There are three different methods that I use to project a company’s future free cash flow.

Predicting Future Free Cash Flow

1. Past Performance

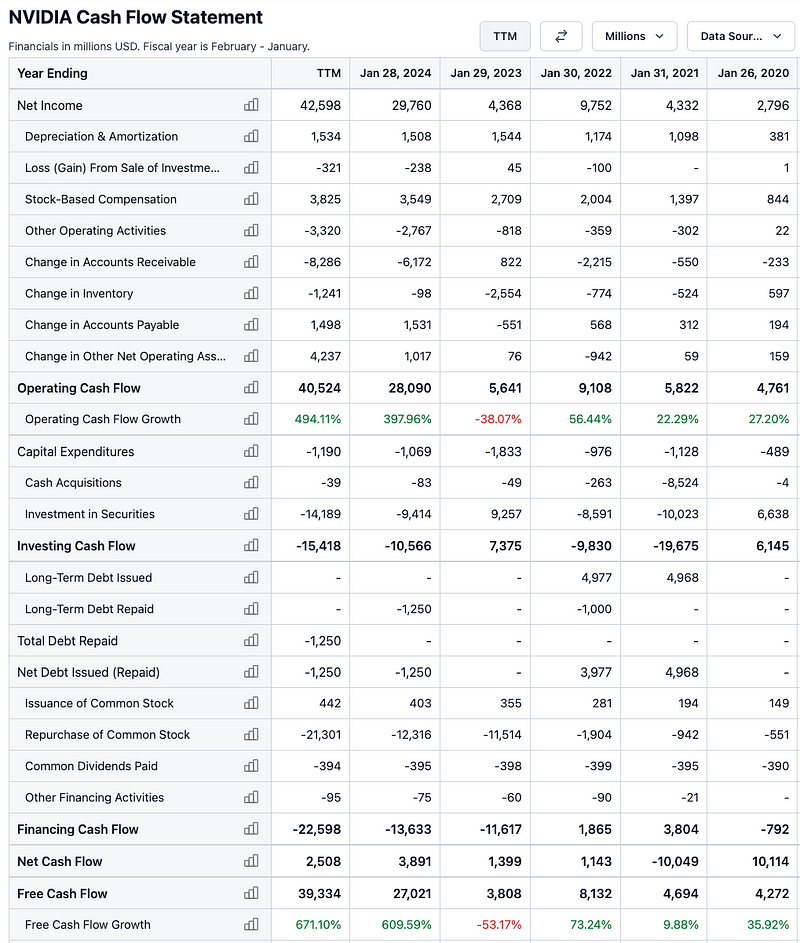

By looking at NVIDIA’s historical cash flow statements from their financial documents, I can see their annualized revenue growth. From 2019 to 2023, NVIDIA’s free cash flow grew from $4.27 billion to $27.02 billion. That is an average annualized growth of 58.59%!

My first method is to use the average annualized growth in free cash flow to project the next five years of free cash flow.

NVIDIA Stock Analysis by Analysts

Using past performance works well when a company is mature and grows at a predictable pace.

NVIDIA, on the other hand, just had 609% free cash flow growth from Jan 2023 to Jan 2024. The bulk of the growth over the last five years comes from just one year.

Past performance is not a reliable method, in this case, since the company is undergoing significant change.

2. Analyst projections

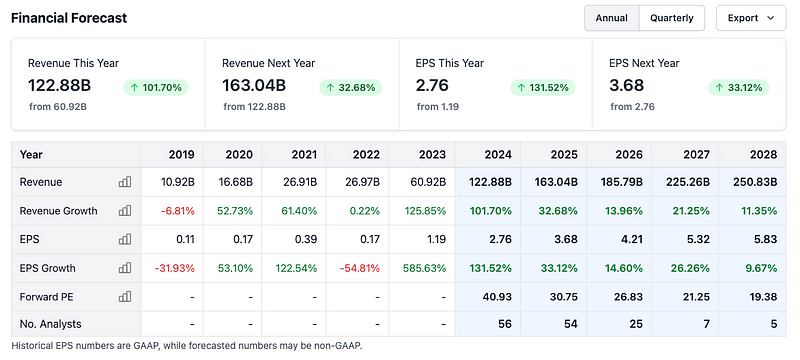

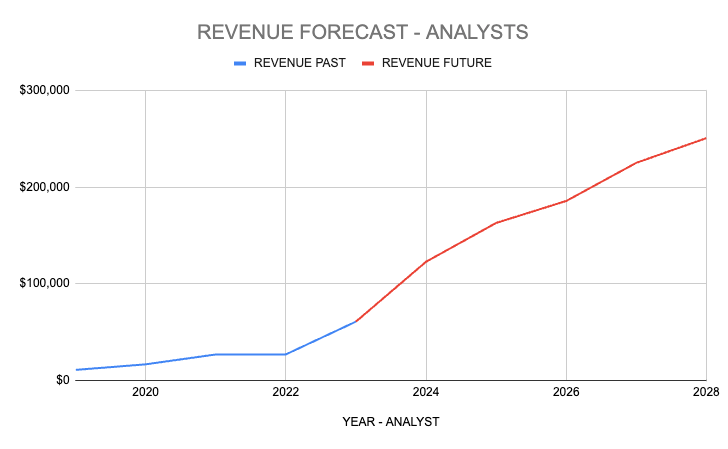

Unfortunately, the analysts do not directly predict NVIDIA’s future cash flows. However, there is a way to combine the analysts’ predictions with another available metric to derive the next five years of free cash flow.

NVIDIA Stock Analysis by Analysts

Revenue projections — the amount of cash that a company gets from operations before accounting for expenses

Free cash flow margin — the percentage of revenue that a company can create free cash flow

NVIDIA Stock Analysis by Analysts

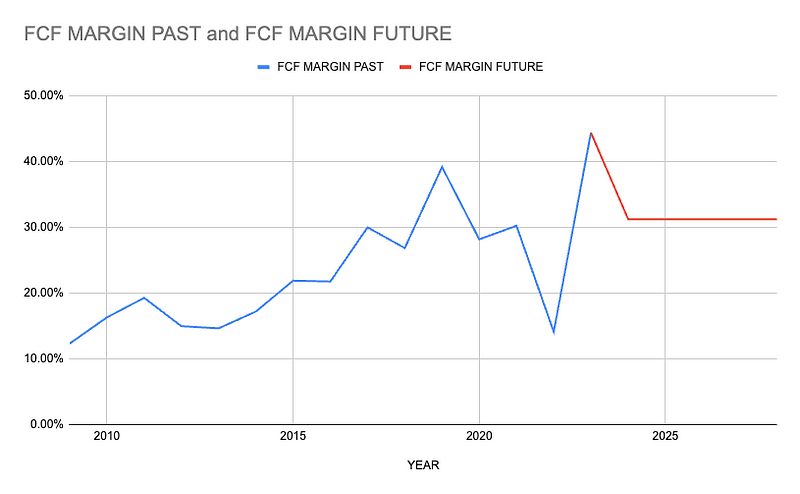

By multiplying the revenue predictions by the average free cash flow margin from the previous five years, I can produce a reasonable estimate for the next five years of free cash flow.

3. My projections

The third projection that I do is exploratory.

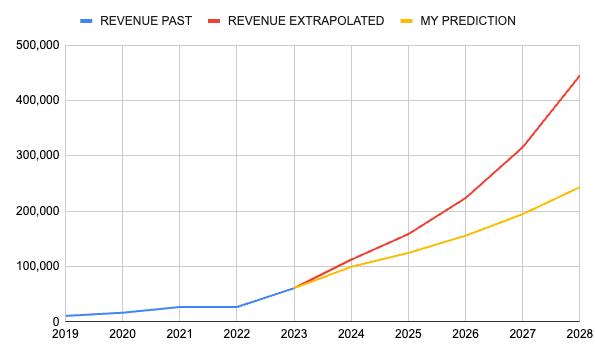

Instead of predicting the free cash flow to determine a fair share price, I can use the current share price to predict future free cash flow growth.

Future Revenue Extrapolated from Past Revenue

This is a handy calculation if there is a significant difference between the intrinsic value and the current share price. It allows me to compare the market expectations to the analyst’s expectation of future growth.

Big and Necessary Assumptions

There are just three assumptions that are built into this projection model.

The projected future cash flow. Nobody can predict the future but we do the best that we can.

The perpetual growth rate is the rate of growth after our five-year projection period. This value is roughly equal to the growth of the US economy or inflation. We are assuming that NVIDIA will continue to grow indefinitely. The perpetual growth rate cannot be greater than the growth of the US economy because of the long time span. NVIDIA would eventually dwarf the entire US economy if that were the case. I will use a perpetual growth rate of 3%.

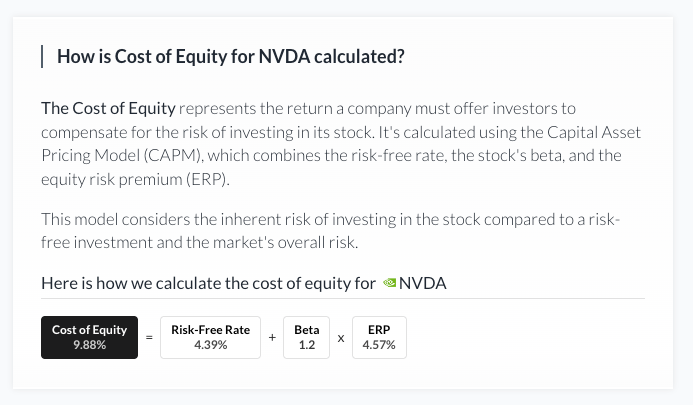

The discount rate, also known as the cost of equity, represents the investment return that a company must offer its investors to compensate for the risk. This model considers the inherent risk of investing in that company compared to a risk-free investment and the market’s overall risk. For this, I use the cost of equity, which can be found with a simple Google search for most publicly traded companies.

How is the Cost of Equity for NVIDIA Calculated?

My Intrinsic Value Calculation

Using my discounted free cash flow spreadsheet with the analyst’s future revenue predictions, average free cash flow margin of 36.2%, perpetual growth rate of 3%, and a 9.88% discount rate for NVIDIA, the calculated fair value is $39.

At the time of writing this article, the current share price of NVIDIA is $124. According to this model and our stated assumptions, NVIDIA is grossly overpriced.

Despite the analyst projections for high future growth, the current share price implies much, much more.

Future Revenue According to the Average Analyst Projections

Tweaking Projections

Now that we have a significant gap between the current share price and the free cash flow model, I will tweak our projections to see what it takes for the model to calculate the current share price.

Free Cash Flow Margin

The first one I want to change is the free cash flow margin.

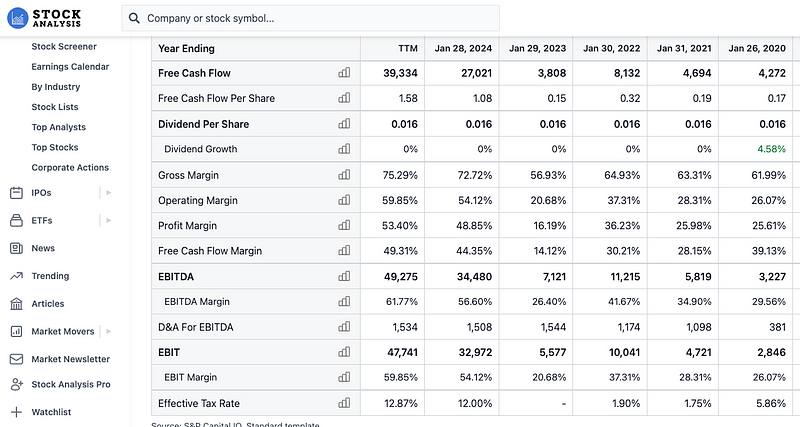

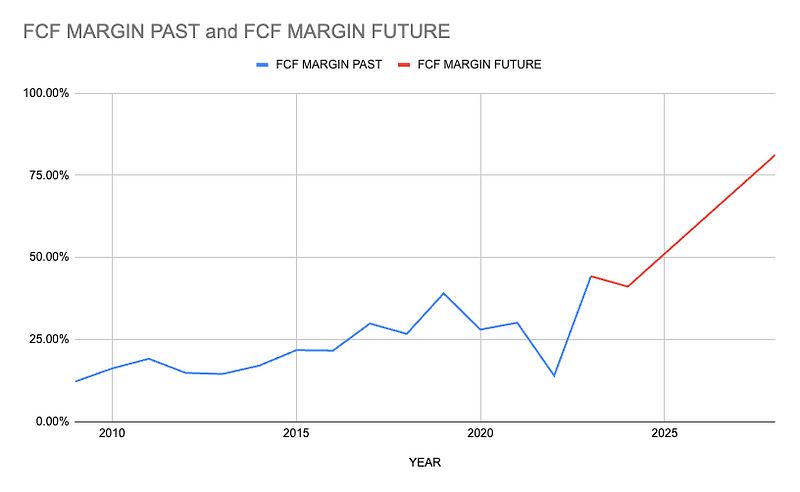

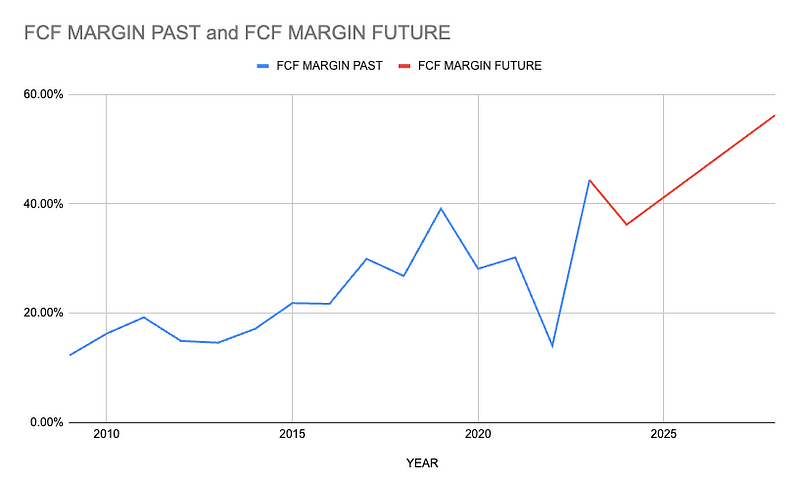

Remember I coupled the analyst predictions of revenue with the past performance of free cashflow margin and used a flat average. However, since 2009 the trend has been a growing free cash flow margin.

Past Free Cash Flow Margin Trend

If I make NVIDIA’s free cash flow margin increase by 5% every year, which brings it more in line with the trend of the past performance, its fair value only increases to $45 per share.

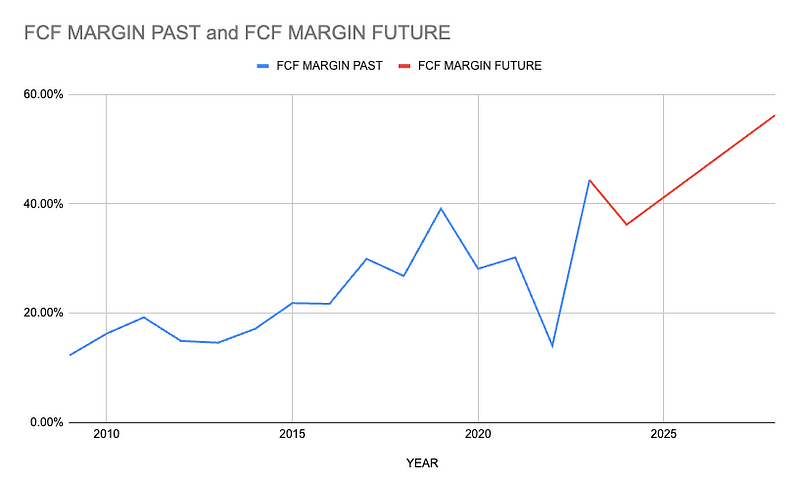

Free Cash Flow Margin Trend Projection

Finally, if I increase NVIDIA’s margin by a staggering 10% every year, the resulting fair value is now just $52.

A free cash flow margin over 75% is most likely unobtainable for NVIDIA. This tells me that no amount of increasing margins will justify the current share price.

$124 per share is only reasonable if revenue is increased far beyond the analyst’s prediction.

Free Cash Flow Margin Trend Projection

Revenue

First, I will bring the free cash flow margin growth back down to a 5% increase per year, which makes it similar to the trend of the past 5 years.

Free Cash Flow Margin Trend Projection

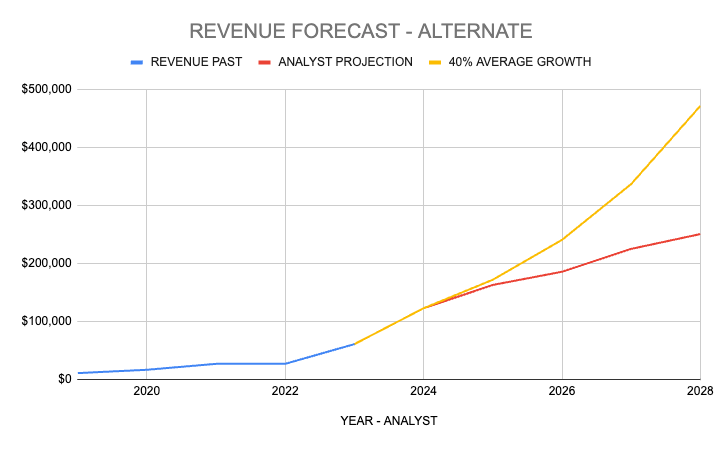

Second, I will adjust the annualized growth of the analyst’s predictions after 2024. I have greater faith in the analysts’ prediction for 2024 than I do for subsequent years simply because it is more difficult to make predictions further out.

The analysts project an average annualized growth over the next five years of 20%. I will increase the average annualized growth by 40% after 2024.

Future Revenue Projections — Average Analyst vs 40% Projection Growth

Assuming increased revenue growth and increased free cash flow growth, the fair value for NVIDIA is now $120 which is just a slight discount to today’s share price, which is $124.

For NVIDIA to be priced correctly right now, they will need to drastically improve margins while simultaneously exceeding growth projects by 20% year over year.

NVIDIA is priced for perfection.

The next question I must answer is: how likely is NVIDIA to stumble?

What Can Go Wrong With NVIDIA?

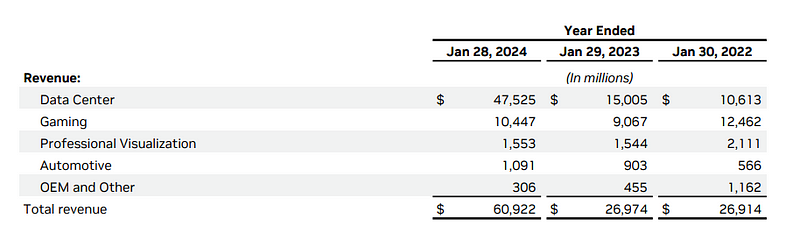

To find this information, I went to NVIDIA’s most recent annual report and looked at their streams of revenue.

The one that jumps out at me immediately is data centers. In January 2023, $15 billion in revenue grew to $47.5 billion in January 2024. This stream of revenue from data centers alone makes up 78% of NVIDIA’s total revenue.

NVIDIA’s 2024 Annual Report

Other streams of revenue include gaming where they sell graphics cards for consoles and computers, professional visualization where they are in 3D design, content creation, and virtual world simulation, and then finally automotive where they’re going to start competing with Tesla for autonomous driving.

Clearly, revenue from data centers is NVIDIA’s most important revenue stream, so this is where I will look for potential problems.

Who are NVIDIA’s Biggest Customers?

NVIDIA’s 2024 annual report has a section dedicated to risk factors. This is where customer concentration makes an appearance.

“Sales to customer A represented 13% of total revenue for the fiscal year of 2024.” — NVIDIA’s 2024 Annual Report

NVIDIA’s 2024 Annual Report

So one customer is 13% of their total revenue, not just their data center revenue! Furthermore, the report says:

“Many of our customers often do not purchase directly from us, but through multiple companies. One indirect customer, which primarily purchases our products through system integrators and distributors, including through customer A is estimated to have represented 19% of total revenue in the year 2024.” — NVIDIA’s 2024 Annual Report

According to this article, NVIDIA’s most important clients for its graphics processing units are the big cloud providers: Amazon, Microsoft, and Google.

Nvidia shows no signs of AI slowdown after over 400% increase in data center business

These make up mid-40%, so more than 40% of their data center revenue in the quarter of April. That article didn’t include META but clearly, META has been a huge buyer of NVIDIA chips as of January 2024.

Mark Zuckerberg indicates Meta is spending billions of dollars on Nvidia AI chips

In my mind, this is a big risk for NVIDIA. They have an incredibly concentrated customer base in their most important sector. If any one of these four core customers were to favor the competition, then NVIDIA would be losing a huge stream of revenue.

This outcome is unacceptable if the current share price is to be justified.

Who is NVIDIA’s Biggest Competition?

NVIDIA’s annual report also has a section dedicated to competition risk.

NVIDIA’s 2024 Annual Report

For GPUs and custom chips, NVIDIA lists AMD, Intel, and Huawei. However, for cloud services, they list Alibaba, Google, Amazon, and Microsoft.

Three of their largest customers are also three of their biggest competitors!

That is horrible because a competitor only needs to make a comparable product to justify the switch. The competition will be able to customize their own chips to suit their needs a little bit better than NVIDIA will be able to do.

This is a major red flag for me.

Also strange that once again, they don’t list META as a customer or a competitor because if I go to META’s website, it says they’re introducing their next-generation infrastructure for AI. They’re coming out with their own custom chip as well.

Introducing Our Next Generation Infrastructure for AI

What is the Verdict?

NVIDIA has three major risks:

The current share price of NVIDIA only makes sense if they continue to grow their revenue at a pace that far exceeds what the analysts think will happen.

All of NVIDIA’s biggest customers are simultaneously NVIDIA’s biggest competition.

NVIDIA gets most of its chips from Taiwan. I know we’ve been hearing about this for years, but, China might invade Taiwan. They’ve been saying they’re going to do it, but they’ve never done it. If the worst happens, then NVIDIA would lose a huge percentage of its manufacturing. This is a third major risk.

China on Track to Be Ready to Invade Taiwan by 2027

If any one of these three risks materializes, it will be impossible to justify the current share price. There are just too many things that can go wrong with NVIDIA for me to invest at this time.

So What Now?

Next, you probably want your own handy spreadsheet for modeling discounted future free cash flow.

Check out my video HERE on building your own spreadsheet that automatically populates the past financials and the future analyst projections which makes it a lot easier.

Or if you don’t want to reinvent the wheel, you can DOWNLOAD MY SPREADSHEET FOR FREE. Check it out.

Catch on the flip side.

Reply