- The Moneycessity Newsletter

- Posts

- 15 Timeless Investing Laws from Legendary Investors

15 Timeless Investing Laws from Legendary Investors

Investing wisely is the key to financial freedom. We will explore 15 essential investing laws inspired by the greatest investors of all time, including Warren Buffett and Peter Lynch, to accelerate your investing goals and avoid financial ruin.

15 of the most important investing laws according to the greatest investors of all time.

Let’s go.

On the go? Watch the video HERE.

15 Investing Laws According to Legendary Investors

1. Marriage

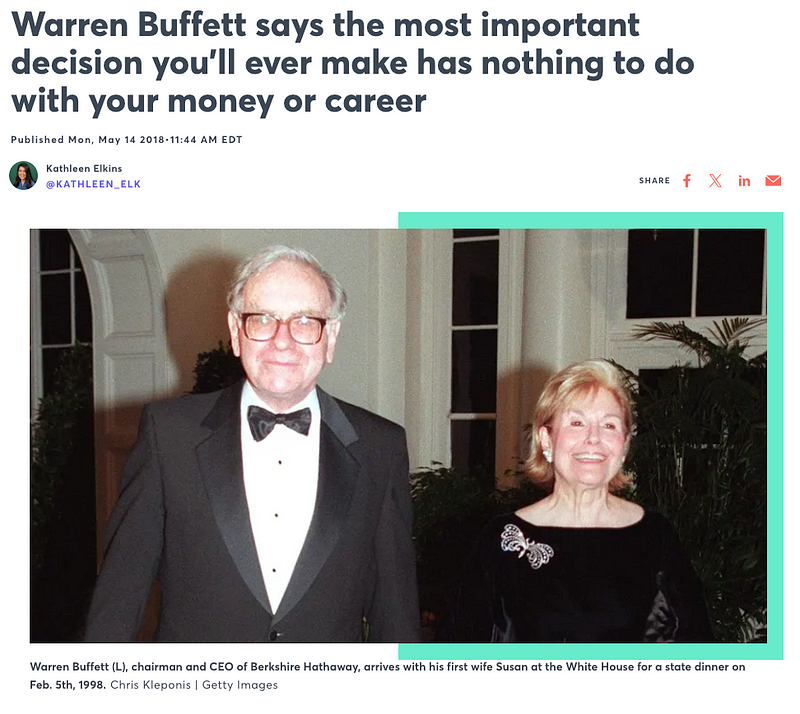

Warren Buffett says the most important decision you’ll ever make has nothing to do with your money or your career.

Warren Buffett on the Importance of Marriage

Of course, he’s talking about your spouse and I am incredibly lucky because my spouse, Natalie, enables me to do great things.

She pushes me and is a very good influence on me. But my spouse could just as easily have been a very bad influence holding me back throughout my entire life.

However, Warren Buffett isn’t quite right.

2. Invest in Your Health

And Natalie is not going to want to hear this but your spouse is only your second most important investment right behind health.

Without my health, I could lose everything. Even my spouse, you know what they say, put on your own oxygen mask before you help other people put on theirs.

By maximizing my health and investing in my health while I’m young, I’ll have a sharper mind and a stronger body. I’ll have more success with my investing journey and I’ll be healthier for longer meaning I’ll be able to enjoy my successes much longer.

So health, for me, is the number one investment. But now we got the cheesy ones out of the way, let’s get into the next law.

3. Preserve Your Capital

According to Warren Buffett, preserve capital.

Don’t lose money sounds like kind of a jokey piece of advice to give.

But behind the surface, there is some hidden wisdom. And that is to not be overly enchanted by the potential upside of an investment but to equally weigh the potential downside.

For instance, Bitcoin could replace fiat currency. It could be absolutely huge. However, it could also be replaced by another cryptocurrency that’s more efficient and a little bit better. So it could also go to zero.

It’s a great reminder to me to really weigh in my mind the potential downsides because after all, a 50% loss requires a 100% gain just to break even once again.

Losses can be even more costly than gains are productive for your portfolio.

4. Think Like an Owner

The next law helps me to limit my downside by thinking like an owner.

Warren Buffett does not care about the short-term movements of the stock, the supply lines, or the resistance lines.

What he looks at is what are the fundamentals of the business.

Am I buying a business that is strong?

Because over the short term, yes, the market is unreliable and unpredictable, but over the long term, the market will properly weigh the value of a company.

And if I’m buying a part of a business, I can be more confident that over the long term, I’m going to have positive results.

One way that I can be sure that I am buying strong businesses is by following the next rule of investing which is to stick to your process.

5. Stick to Your Process

Sticking to a system allows me to avoid making emotional decisions.

I like to set up a limit sell and a stop loss. That way, if a stock is ripping up or crashing down, I’m not vulnerable in that moment to making an emotional decision, one that is not optimal for my portfolio.

Also, sticking to a system when buying a stock helps to compare companies apples to apples.

For instance, I’m looking at investing in NVIDIA and I’m also looking at Home Depot.

In the end, all that matters is the total returns, so I’m not going to be overly enchanted by the potential upside of NVIDIA. I’m going to stay disciplined which is the next law for investing according to Peter Lynch.

6. Maintain Discipline

The most important organ in my investing body is my stomach, and I have to have a great stomach on both the buy and the sell.

The most important organ in my investing body is my stomach, and I have to have a great stomach on both the buy and the sell.

For instance, I don’t want to rush into a bad investment because it’s much better to be late into a great investment.

And then when the stock market is crashing, I’ve got to have the stomach to hold onto my shares, not sell at the worst time because I know in the long term the stock market tends to go up.

The next law of investing helps to make it easier to hold stock through a crash and that is to build an emergency fund.

7. Build an Emergency Fund

Stock market crashes are heavily correlated with increases in unemployment.

There is nothing worse than if I lost my job and then I’ve got to sell my losing stocks at the worst time just to pay my rent or keep the lights on or put gas in the car.

So having that emergency fund really makes it possible to stick to my investments even when they’re temporarily, hopefully temporarily at the bottom.

Having an emergency fund doesn’t only keep me from selling, it also gives me the confidence to buy, which is the next law of investing.

8. Buy When Others Are Fearful

The periods immediately following a market crash have historically had some of the best returns. That is because with increased risk generally correlates with increased returns.

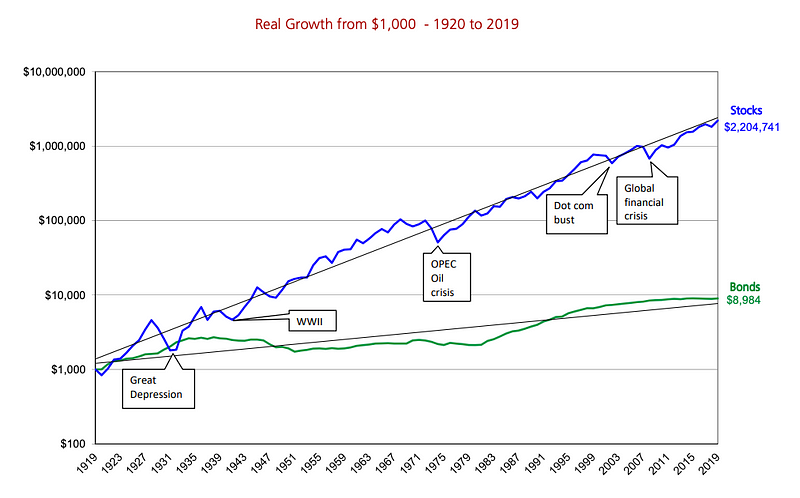

You’re not gonna get good performance long-term out of bonds compared to the stock market.

For instance, over the last 100 years, a diversified bond fund, if you invested $1,000 in 1919. In 2019, it would turn into $9,000.

During that same amount of time, starting with that same amount of money, investing in the stock market would turn into $2.2 million.

Stock vs Bond Performance — 100 Years

Over the long term, I can be confident that the stock market is going to go up in general and my portfolio is going to go up as long as I follow the next law of investing, which is to diversify your holdings.

9. Diversify Your Portfolio

This one’s a little bit counterintuitive. Bill Hackman points out that you don’t actually want too many holdings.

If you have 50 to 100 companies that you’re invested in, that’s going to lock you into average returns.

If you’re chasing above-average returns, you only need 10 or 12 to get the benefits of diversification which is having companies that are not heavily correlated that are exposed to different market sectors.

For instance, if I had all my money invested in horses and carriages 200 years ago, I would be in trouble now. I want to make sure that my holdings are properly diversified among the different sectors. That way I can get access to those long-term, solid returns.

That being said, I have to be honest with my skills and with my time.

If I’m going to go after above-average returns, then I have to have more responsibility when I’m selecting stocks. I have to follow the next law of investing which is to understand your investment.

10. Understand your Investments

Simple and understandable businesses in my circle of competence are gonna be much more realistic targets for me to roughly predict the long-term trajectory of that company.

In the short term, the stock market is all over the place. But in the long term, it will realistically and accurately weigh these companies for the direction that they’re headed.

If a company is truly strong and it’s growing over the long term, the stock market will evaluate that.

However, I have to be realistic with myself.

If I do not have the time or the expertise to correctly and realistically evaluate a company, then I need to follow the next law of investing which is to buy low-cost, high-quality ETFs or index funds.

11. Invest in Low-Cost, High-Quality ETFs

When I don’t have the time or the expertise, investing in ETFs or index funds is the way to go.

Just getting average market returns will make me rich.

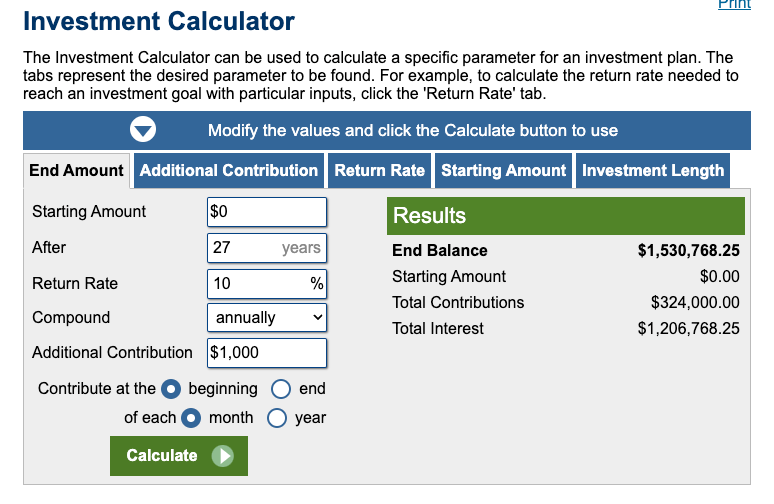

Investment Return Calculator

The S&P 500, for instance, averages 10% annualized per year. If I invested $1,000 per month starting at the age of 18, I would have $1.5 million by the time I was 45 years old.

This is really good. Now it gets better and better the earlier you start, which is the next law of investing: Invest early.

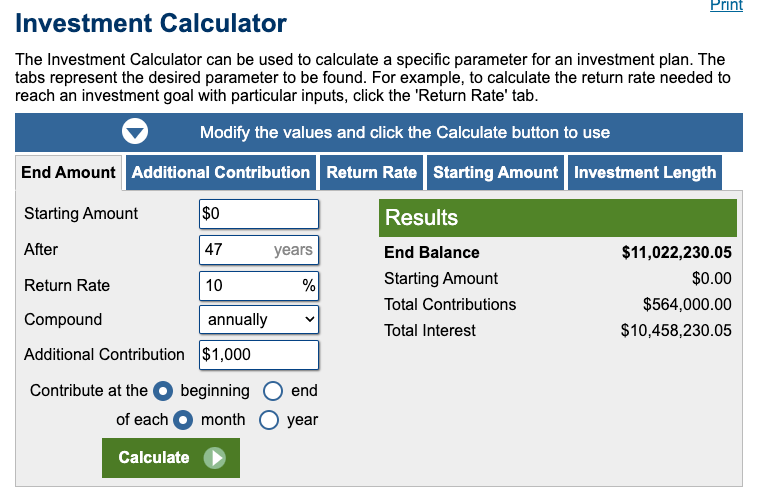

12. Invest Early

The power of compounding really only comes into play when you take advantage of it for long periods.

That first example, investing from 18 to 45 got us $1.5 million. If you go another 20 years, you’re not going up to $3 million, you’re going up to $11 million.

The rate of increase just accelerates and accelerates.

Investment Return Calculator

And the next law of investing helps me to continue to take advantage of it, which is to invest often.

13. Invest Often

I like to automate my savings. I have direct deposit set up.

So directly from my paycheck, I’ve got money that goes into my 401k. It automatically invests in low-cost, high-quality, diversified ETFs.

I’ve got direct deposit going into my brokerage account, which I like to use to invest in individual companies when I have the time and I have the confidence that I can accurately evaluate said company.

This happens to me every single week. I don’t have to think about it. And this helps me not to break the next law of investing which is don’t time the market.

14. Avoid Market Timing

Even Peter Lynch, one of the greatest investors of all time, does not bother timing the market.

He knows that time in the market is superior. And that’s because market returns are incredibly concentrated on just a handful of trading days.

It’s very unlikely for me to pick the handful of days where the market gets the bulk of its returns.

It’s much better for me to just have my money in there the whole time. That way I can be sure that I’m invested on all of those trading days.

If I think something is going to cause a crash, the market’s already aware, it’s probably already priced in.

I have to be very careful about thinking that I can predict a market trend because the next law of investing is to avoid the obvious.

15. Avoid the Obvious

If something is truly obvious to me, then the market probably already knows about it.

We live in the age of information and the pools of smart money are getting bigger and bigger. Billions of dollars are changing hands as insiders have access to information way before the masses.

So if the masses are all talking about something, then it’s probably already priced in.

I try to stay laser-focused on my own analysis. What do I put the intrinsic value of a company at? And I ignore what everybody else is saying.

So What Now?

That being said, calculating the intrinsic value of a company will never be perfect, but it will get me pretty close, especially if it’s an easy-to-understand business within my circle of competence.

I shared my basic techniques and calculations for determining the intrinsic value of a company. If you’re interested, check it out HERE.

Catch you on the flip side.

Reply