- The Moneycessity Newsletter

- Posts

- Could the 2024 Bitcoin Halving Spell the END of Bitcoin?

Could the 2024 Bitcoin Halving Spell the END of Bitcoin?

What is Bitcoin Halving and how does Bitcoin Halving 2024 affect the value of future Bitcoins? We will delve into the impact of the upcoming Bitcoin Halvening in April 2024 and its potential future implications on Bitcoins. We discuss how the gradual decrease of Bitcoin supply every four years might affect its price, security, and mining. We also explore the implications of Halvening on the security and centralization of Bitcoin mining.

The halvening is rapidly approaching, and the implications for Bitcoin are HUGE:

Potential price swings

Drop in security

The demise of Bitcoin.

In this article, I’m going over what you can expect from the halvening in April of 2024 and what you can expect from halvenings in the future.

On the go? Watch my video HERE.

Let’s get into it.

What is Bitcoin Halving

Bitcoin mining is the process by which new Bitcoins are added into the circulation.

The halvening is an event that happens every four years where that supply rate is reduced by half.

The rate of supply will continue to reduce by half every four years until in the year 2140 there will be no more new Bitcoins.

The total supply will be capped at 21 million bitcoins.

The question that everyone’s asking is what effect on Bitcoin will a sharp and sudden but predictable drjop in supply have.

How Bitcoin Halving Effects Bitcoin Price

The knee jerk reaction of course is that a sudden drop in supply, assuming the demand is the same, will result in an increase in the price of Bitcoin. One fact that people point to to support this conclusion is the historical movement in Bitcoin price at the previous halvenings.

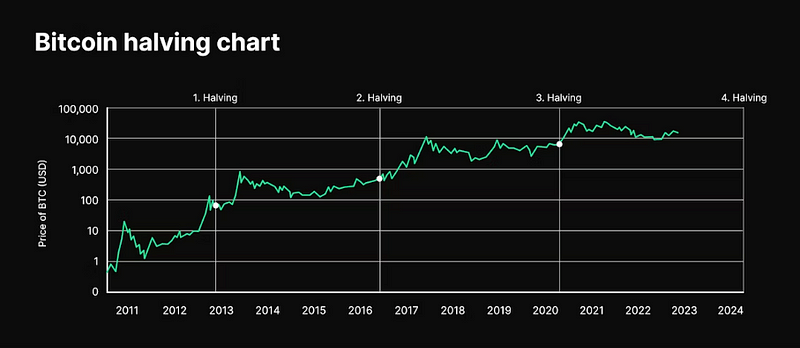

This chart shows the price on a logarithmic scale over time with the previous Bitcoin halving events called out.

Bitcoin Halving Events Affecting Bitcoin Price

There has consistently been a medium and long term price increase following each Bitcoin halving event. In fact, the price has consistently 10x’d from one halving event to the next.

So, it’s a no brainer then. Will the price of Bitcoin certainly go up following April of 2024? Not so fast.

Even though it is a mathematical fact that the supply rate will slow and the rarity will increase, the pricing of commodities is always forward looking.

In theory, there should be no short term price impact from the sudden drop in supply because the whole market knows that it’s coming and that drop in supply should already be priced in. The actual price increase should be smoothed out over the four year period from one halving to the next.

Of course, in practice, things are always much different than in theory. The pricing of other commodities will react much more strongly to sudden changes in the supply because the supply rate is unknown in the future.

Commodity Spot Prices versus Futures Prices

Bitcoin differs from other commodities in that supply rate of other commodities cannot be 100% known in the future.

Let’s say there’s a huge fire and the supply of grain is suddenly halved. This would have a huge impact on the pricing because that change in supply was not known.

As for the historical price movements of Bitcoin surrounding these halvening events, the supply rate is not the only factor to consider.

It is impossible to know exactly how much the price change is a result of the supply rate or other factors like social acceptance or SEC regulations.

In my opinion, the dwindling supply is necessary but it’s not sufficient for the price of Bitcoin to continue to go up in the future. The groundbreaking properties and uses of Bitcoin must be coupled with social acceptance for it to continue to have value.

My primary concern with the halvening is the potential effect it could have on the security of Bitcoin. Let me explain.

How Bitcoin Halving Affects Bitcoin Security

Bitcoin mining isn’t solely about increasing the supply of bitcoins.

Bitcoin miners only receive that reward for verifying transactions of Bitcoin. Many Bitcoin transactions are bundled together into a “block” with certain cryptographic properties. All of the Bitcoin miners are competing to complete this process as fast as possible. Essentially, the more computing power that a Bitcoin miner has, the greater the likelihood that they will be the first one to complete this process.

Now, more computing power doesn’t mean you always are the first one because there is a luck factor involved.

The security in this comes from consensus.

Bitcoin Mining Security illustration by author

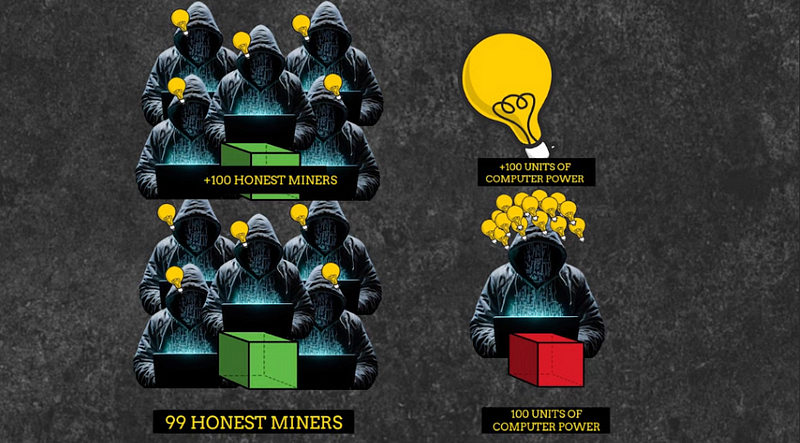

Let’s assume for a minute that all the Bitcoin miners have the exact same computing power. For a block to be confirmed and added to the blockchain, a majority of the miners must be working to confirm that exact same block with that exact same bundle of transactions.

For instance, let’s say one evil bitcoin miner is trying to fabricate a fake transaction that will add 1 million bitcoins into their account. The evil miners block will not match everyone else’s block because it will have one extra transaction. And since the evil miners block will not have consensus, it will be rejected and cannot be added to the blockchain.

In reality, you do not need 51% of the Bitcoin miners to be in consensus. You really just need 51% of the total computing power that is going into the mining process at any given time.

For instance, if there are 99 honest miners, each one with 1 unit of computing power, and 1 evil miner, the evil miner needs 100 units of computing power to have the majority.

If we then have more honest miners, let’s say it goes up to 199, each with one unit of computing power, the evil miner now needs 200 units of computing power.

The more people you have competing for that Bitcoin reward, the more secure the system is.

So the more honest miners you have working to verify transactions and get that Bitcoin reward, the more difficult it’ll be for an evil miner to come up with 51% of the computing power.

Bitcoin Mining Majority Consensus Illustration by author

This is where my problem with the halvening comes in.

The problem with the halvening is that on that day, the total reward for all miners is going to be suddenly reduced by half.

Remember, Bitcoin mining is not cheap. Bitcoin miners have to invest in expensive hardware and have to pay constant high electrical bills to run that hardware.

Some Bitcoin miners will no longer be profitable after the halvening, until the price of Bitcoin can go up enough to make up for the reduced supply.

When the unprofitable miners leave the pool, the security will be temporarily lower.

This has scary implications for two reasons:

The security go down

Mining becomes more centralized

It will be the little guys that pushed out first because they lack an economy of scale. In the long term, we do not want Bitcoin mining to be concentrated amongst just a handful of the largest corporations.

Currently, the reward for verifying a block for the blockchain is 6.25 bitcoins. After the halvening in April of 2024, that reward will be reduced to 3.125 bitcoins.

It’s important to remember that the rate of new blocks is constant. One new block is added to the blockchain every 10 minutes.

At the current price of Bitcoin, which is around $41,500, we can calculate how much money Bitcoin miners are paid every day. A block every 10 minutes means there will be 144 blocks mined every day. Each block currently pays 6.25 bitcoins worth $41,500 each. This equals just over $37 million per day.

Bitcoin Mining Reward Illustration by author

At today’s price, honest miners are paid a lot of money to verify transactions. $37 million a huge pie for all of the miners to split up. Everybody is getting a good cut. As a result, there are a lot of Bitcoin miners and the security is good.

For now.

We don’t really know how much money is required to maintain the security of the Bitcoin network. But, every time we have a Bitcoin halving event, we get closer to finding out.

How Bitcoin Halving Affects Transaction Fees

Losing security isn’t the only thing that can bring about the demise of Bitcoin. There is another issue lurking in the mining process.

As the reward for mining continues to get halved every four years, the only way to make up for the lost pay to miners is through transaction fees.

Currently, transaction fees are optional and are really more of a priority fee. If you want your transaction to be verified first and you need it done quickly, you can pay a small fee so that Bitcoin miners will prioritize your transaction over the others that don’t have a fee.

However, fees might stop being optional if the Bitcoin payment incentive for miners drops too low.

Bitcoin Halving Explanation by Satoshi Nakamoto

The creator of Bitcoin, Satoshi Nakamoto wrote: “In a few decades, when the reward gets too small, the transaction fee will become the main compensation for nodes. I’m sure that in 20 years, there will either be very large transaction volume or no volume.”

The creator correctly points out that if the transaction volume is high enough, then the fees can be low and still result in enough money going to the Bitcoin miners.

However, if the transaction volume drops, then the fees will have to be increased to keep the same incentive in place for honest miners.

If transaction fees go too high, then more people will stop wanting to use Bitcoin, and then the volume drops and fees go higher and it’s a vicious cycle.

The problem here is that the transaction volume can only be increased so much.

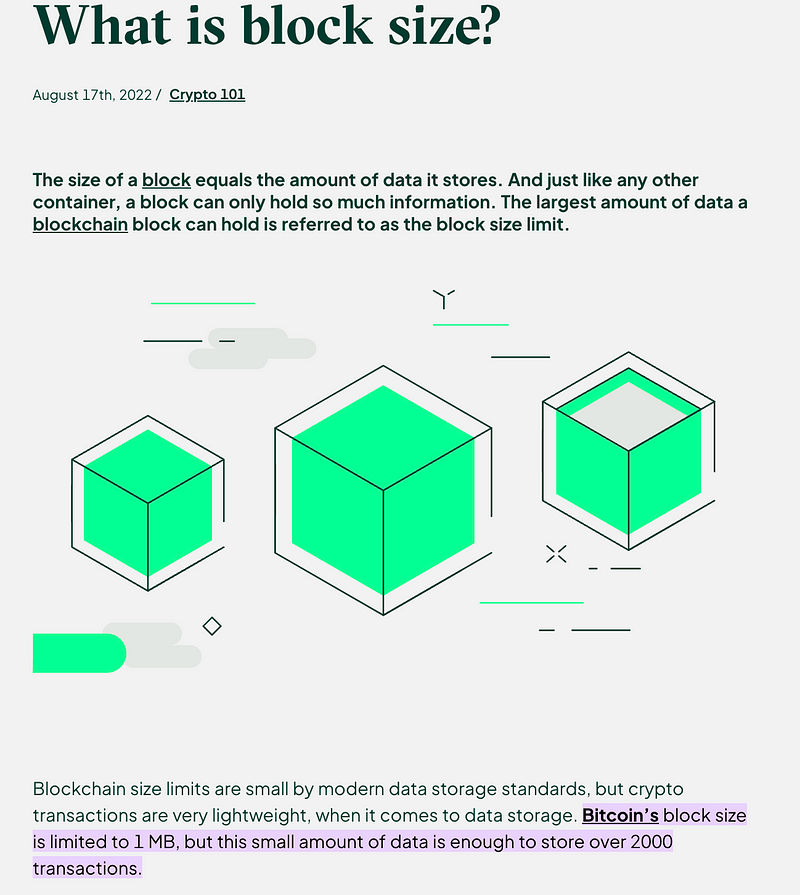

You already know that the rate of new blocks is constant with 1 every 10 minutes. But did you know that the size of each block has a ceiling?

What is a Bitcoin Block?

A single block can hold a maximum of 1 Megabyte of Bitcoin transactions.

This means that there is a cap to how many transactions can be processed in a day.

As Bitcoin becomes more popular and the number of transactions per day increases, there will be a point where the Bitcoin network cannot keep up. Slow transaction speed and higher fees will absolutely hurt the popularity of Bitcoin.

This can be incredibly damaging to Bitcoin since social acceptability is necessary for Bitcoin to maintain the demand that it has today.

In the long term, the current state of Bitcoin is threatened by future Bitcoin halving events. However, in the medium term, there are some exciting changes that should be positive for Bitcoin’s popularity.

The SEC just announced the approval of the new Spot Bitcoin ETFs. Not only does SEC approval give social credit to Bitcoin but having Spot Bitcoin ETFs makes it easier for new investors to invest in Bitcoin.

The only question now is which one is the best. Click on HERE where I analyze all 11 of the new Bitcoin ETFs. Catch you on the flip side.

Reply